The rise of online shopping trends has significantly accelerated the development of today’s Chinese market. Cosmetics brands, in particular, showed increased demand for the past few years, with over $15.49 billion predicted revenue in 2023.

Currently, international brands cover more than 60% of the local cosmetics market. Because of this, more foreign marketers are understandably looking for new ways to sell their products to Chinese consumers.

Here’s a brief guide to the best Chinese marketplaces to sell cosmetics and other crucial insights to make your marketing strategy more effective within the local business scene.

11 Chinese Online Marketplaces for Foreign Cosmetics

1. Tmall

Tmall is a leading e-commerce platform owned by Alibaba, covering 45% market share in China. Today, Chinese consumers consider this online shopping app the top source of authentic skincare and cosmetics products.

This trust is critical in the beauty industry, so it’s not surprising that the platform generated approximately 17 billion yuan in sales revenue between 2021 and 2022.

As a cross-border e-commerce platform, Tmall became a local beauty industry portal for new foreign brands attempting to break into the Chinese market.

In fact, modern Chinese beauty consumers in Tmall are already familiar with foreign cosmetic and skincare products. International beauty brands like Estée Lauder, L’Oréal, and Shiseido have established their local presence and leveraged the platform’s mass audience reach.

According to Retail Asia’s 2021 report, this popular online shopping channel has welcomed 400 foreign brands every month for the past few years. The demand for these imported goods encompasses around 5,800 categories, including beauty products.

Our work with Elevant Tmall flagship store revamp

When selling a foreign cosmetics brand in Tmall, it’s important to note that it’s not like traditional e-commerce platforms. It has several social media marketing tools like live-streaming and KOL collaborations that marketers can utilize to appeal better to Chinese consumers.

Incorporating these interactive tools into your digital marketing strategy can be pivotal to growing your consumer base and driving sales on Tmall.

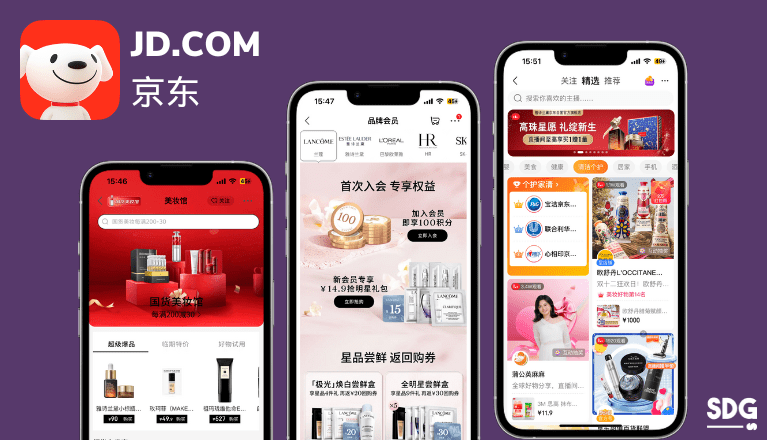

2. JD.com

Unlike other Chinese e-commerce platforms, JD.com or Jingdong do not utilize third-party sellers. It only operates through a direct sales model, allowing foreign brands to have greater control over their inventory, pricing, and the overall brand image of their beauty products.

This cross-border e-commerce platform serves over 580 million active Chinese consumers, most of whom consider the app a source of high-quality products. With this positive reputation, foreign cosmetics brands can emphasize the credibility and authenticity of their products.

Another reason many foreign companies choose JD.com to sell cosmetics is its advanced logistics network. You may not know, but it’s one of the best e-commerce platforms that offers Chinese consumers fast and reliable delivery services across China.

Since most foreign cosmetics brands have no physical presence in the country, this logistical efficiency is a significant advantage in ensuring products reach consumers promptly and in good condition.

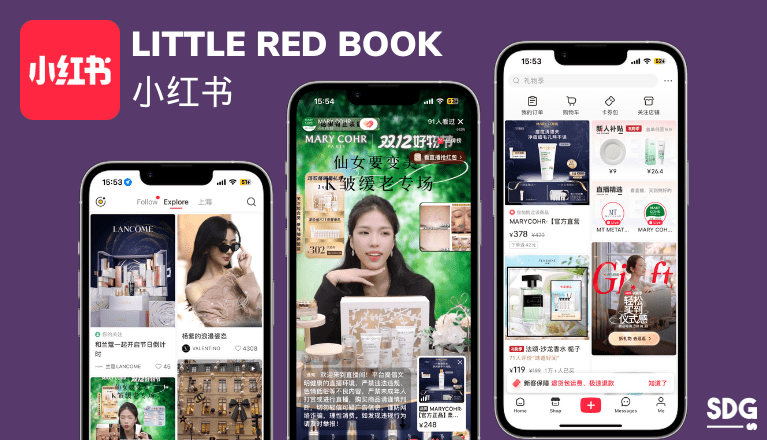

3. Little Red Book (Xiaohongshu)

Little Red Book is not only a top e-commerce channel in China. It’s also one of the Chinese social media platforms that mainly thrive in community-driven content about skincare and cosmetic products.

Xiaohongshu has a predominantly young, urban, and female user base, so the product categories that bring more revenue within the platform are unsurprisingly from its beauty and skincare market.

Thanks to the platform’s social e-commerce features, Chinese consumers can rely on user-generated content before purchasing. It often includes tutorials, reviews, and unboxing videos that help build brand trust and awareness.

With users spending considerable time browsing, reviewing, and discussing products, marketers can take this chance to work with Key Opinion Leaders on the platform. There are over 10 million influencers in China, and most of them have a massive follower base that trusts their recommendations.

Numerous international beauty brands have successfully leveraged Little Red Book to engage Chinese consumers. One look at Little Red Book, and you’ll see many foreign companies like L’Oréal and SK-II have active presences on the platform, utilizing it to build brand reputation and generate direct sales.

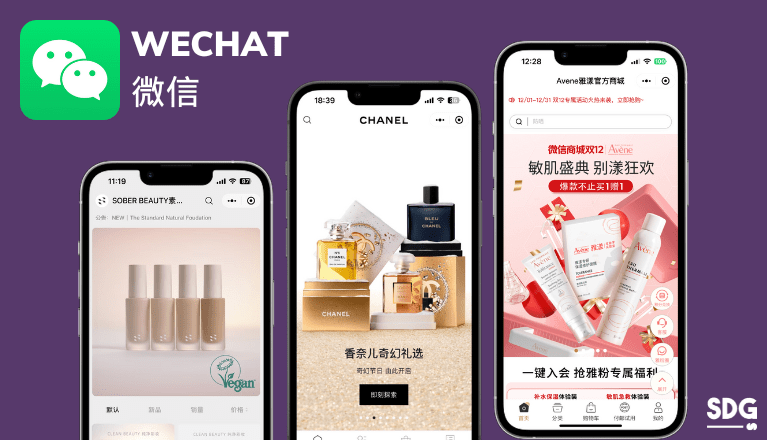

4. WeChat Store

With approximately more than 1.3 billion monthly active users, it’s a no-brainer for any marketer to have a brand launched on WeChat. However, besides being one of China’s largest social media platforms, did you know you can also establish an e-commerce store in this super app?

In 2013, the platform decided to introduce e-commerce features to its users. Besides social media engagement, local consumers can have a convenient shopping experience by checking out products on the brand’s official account and paying through WeChat Pay without being redirected to other platforms.

According to recent surveys, over 100 million WeChat users shop through different mini-programs to buy at least one item.

This high e-commerce demand has been leveraged by familiar names in the global beauty market, like Lancôme and MAC Cosmetics. Like these brands, you can utilize WeChat’s full-scale social media marketing and advertising tools to communicate directly with your target audience through the brand’s official account.

You should know that local consumers are especially wary of counterfeit goods, including imported cosmetic products. Because of this, having verified accounts on Chinese social media and e-commerce platforms not only gives these brands access to advanced features but also establishes their credibility in the cosmetics industry.

5. Douyin Flagship Store

While Douyin is an effective tool for social media marketing strategies, you can also use it to establish a Chinese cosmetics online shop for your brand. Through its e-commerce features, users can discover your products within video feeds and purchase them without leaving the app, facilitating a smooth transition from promotions to sales.

Besides having a massive market share in the local social media industry, it has a relatively young user base. Its dominating age group ranges from 18 to 35 years old, simulated by interactive content.

So, if you want to introduce a foreign cosmetics product using this social commerce platform, you must foster real-time interaction between the brand and your potential audiences.

Besides launching ads or posting creative video content, the best way to generate traffic to your virtual store is to promote your cosmetics products through Douyin’s live-streaming channels. You can also try to collaborate with the platform’s active influencers who are known in the local beauty market.

You’ll have no problem finding an ambassador for your brand because this social media channel thrives in user-generated content. If anything, you’ll have to choose carefully among the pool of over 30,000 Key Opinion Leaders (KOL) and Key Opinion Consumers (KOC) actively creating content on the app.

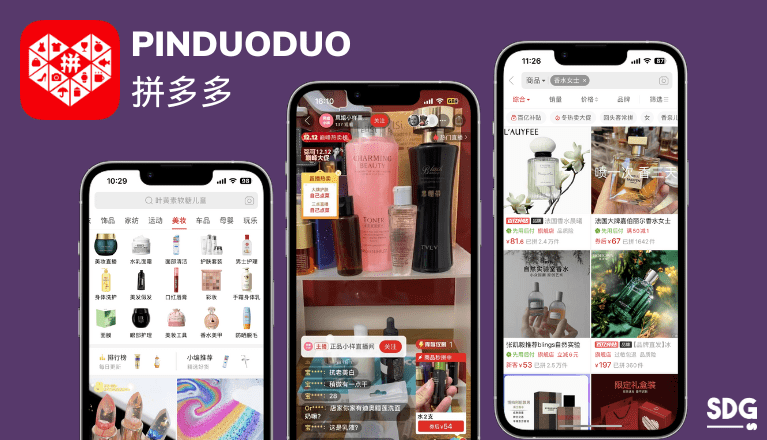

6. Pinduoduo

If you ask us, Pinduoduo is the e-commerce platform with the most unique business model among other options on this list. For starters, it operates with a group buying concept, where users can obtain lower prices by purchasing items collectively.

Although Chinese consumers are known for their love of premium cosmetics products, this distinct market structure encourages them to try new brands and products through attractive pricing opportunities.

It’s not as extensive as other social media marketing platforms, but Pinduoduo allows users to leave reviews about the cosmetics products they bought from your virtual store. This engagement eventually fosters a sense of community and generates peer-to-peer recommendations, which are especially valuable for beauty companies.

As a cross-border e-commerce channel, it’ll not only allow foreign brands to sell in China without a physical presence but also serve as a cost-effective option for those new to the market or with limited budgets.

7. Yunji

Yunji is a membership-based online shopping platform, so not all brands can enter the local market through this channel. It carefully selects brands and products to sell with the goal of providing its users with high-quality products at excellent prices.

The platform commenced its cross-border e-commerce trades in 2016, opening its online channels for the entry of foreign brands. Today, Yunji is home to a wide range of products related to daily needs, like digital gadgets, children’s toys, and fresh foods.

Due to its exclusive nature, Yunji attracts consumers looking for specific, high-quality items while maintaining a sense of luxury. Other users find online shopping in this channel appealing because they often find products priced at wholesale, which means they get better quality for less money.

Since Yunji has a very specific user base, the link between the brand and end-users is not too complex. Your consumers can give direct insights about the brand, allowing you more time to tailor your offerings according to their needs.

Unlike traditional cross-border e-commerce platforms, where brands might launch multiple products to test the market, Yunji allows brands to quickly adapt to consumer feedback, increasing the likelihood of producing popular goods.

8. Jumei

Jumei was the first local online marketplace to sell cosmetics in China way back in 2010. While less popular than other cross-border e-commerce sites, it holds 22.1% of the country’s cosmetics sales.

It focuses on selling beauty products at reduced prices to differentiate itself from major competitors like Tmall and JD.com. This strategy is aimed at attracting consumers with limited spending power.

The platform’s price-focused strategy could help foreign marketers reach a broader segment of consumers, particularly those who are cost-conscious but still interested in high-quality cosmetics products.

Furthermore, Jumei goes beyond just selling cosmetics online. It also offers a wealth of information relevant to its Chinese audience. It includes reviews of different brands, recommendations for cosmetics products, and tips on makeup and skincare.

9. VIPshop beauty

VIPshop Beauty is one of China’s top three profitable B2C platforms. Many local consumers know this e-commerce website for offering discounted prices on cosmetics brands. Its current popularity is primarily due to its successful partnerships with famous brands, selling their excess inventory at reduced rates.

In 2019, VIPshop saw a significant increase in activity, with total orders reaching 116.5 million and active users climbing to 29.7 million.

This platform is especially suitable for brands with excess inventory, allowing them to clear stock while efficiently reaching a vast audience.

VIPshop’s large user base and proven track record in the cosmetics sector make it an attractive platform for foreign brands seeking to establish or expand their presence in the competitive Chinese market.

10. Kaola.com

Since Kaola.com mainly specializes in procuring foreign goods directly from overseas manufacturers, it has become a preferred destination for imported cosmetic products.

Over the years, this marketplace has built a reputation for ensuring the authenticity of its products. Thanks to this image, many international beauty companies could maintain their local presence within the platform and build a loyal buyer community in China.

In 2022, the platform has seen rapid growth in its sales volume, raking over $80.7 million in revenue. The top product categories generating this annual include beauty products and health supplements.

Kaola is not a social media channel, but it offers a range of promotional tools for product showcases, special events, and influencer marketing campaigns. On top of that, marketers can also rely on its valuable consumer insights and data analytics to understand Chinese consumer preferences and tailor their products and strategies accordingly.

Like JD.com, Kaola is known for its vast logistics network. It can facilitate warehousing and smooth customs clearance processes. Through this feature, foreign businesses can ensure that their products are delivered to consumers efficiently, maintaining product integrity and customer satisfaction.

11. Sephora China

Despite being a company initially from France, Sephora established itself as China’s second most popular multi-brand beauty retailer. In 2021, it had approximately 315 local stores, primarily located in major cities.

This platform provides an authentic and trustworthy online shopping experience, combining online and offline presence to showcase a vast range of cosmetics.

The brand’s significant market share in China results from its innovative e-commerce strategy, which includes not only Sephora.cn but also collaborations with various other online platforms in China’s beauty market.

With Sephora’s multi-channel approach, it was able to unlock an opportunity for many cosmetics brands to reach more audiences and cater to diverse consumer needs.

By featuring their products on this platform, you can leverage its reputation for authenticity and quality. Sephora’s widespread physical stores can offer consumers a tangible product experience, enhancing brand visibility and trust.

What are the laws for cosmetics in China?

Cosmetics in China are categorized into two main types – special and general. Special cosmetics include products like hair dyes, sunscreens, and skin whitening products, which require more rigorous testing and approval processes. The other category faces relatively more straightforward registration or filing requirements.

In terms of packaging, all cosmetics sold in China must have labels in Chinese, including the list of ingredients, usage instructions, and manufacturer details.

You should also ensure that claims made on labels and advertisements must be substantiated and cannot be misleading.

Quick Q&A

How to Sell Cosmetic Products in China?

Selling cosmetic products in China involves ensuring compliance with the National Medical Products Administration (NMPA) regulations, which oversee beauty products’ safety, labeling, and marketing. Businesses can enter the market by establishing a local entity, partnering with local distributors, or leveraging cross-border e-commerce platforms.

How strictly regulated is the beauty care market in China?

The beauty care market in China is subject to stringent regulations. Governed by the National Medical Products Administration (NMPA), the industry faces strict oversight regarding product registration, ingredient compliance, labeling requirements, and advertising practices. The regulations are particularly rigorous for special cosmetics, including hair dyes and sunscreens, requiring detailed testing and approval processes.

Where to sell beauty products in China?

Beauty items in China can be sold through various channels. Online platforms such as Tmall and JD.com are popular choices, especially for foreign brands looking to tap into the Chinese market without establishing a physical presence. For offline retail, high-end department stores, beauty specialty stores, and pharmacies are traditional avenues.

What is the tax on cosmetics sold in China?

In China, cosmetics are subject to a 17% value-added tax (VAT). A consumption tax is also applied at 15% for premium cosmetics, with no consumption tax for non-luxury items. Imported high-end cosmetics incur a 50% import tax. These varying rates may change at any given time, so it’s advisable to consult a tax professional for current and detailed guidance.

Ready To Dominate The Chinese Beauty Market? Get In Touch With Us Today!

From gigantic platforms like Tmall and JD.com to niche sites like Xiaohongshu (Little Red Book) that cater to specific demographics, foreign companies can count on China’s digital landscape to have a space for selling different cosmetics products.

You may also want to read:

However, it’s crucial for brands to understand the distinct preferences and shopping habits of local consumers. Success in this market segment requires not just a presence on the right platforms but also an adaptable, culturally aware, and innovative approach to marketing.

Whether it’s for setting up an online shop, crafting compelling paid advertising campaigns, or harnessing the power of SEO and social media, SDG has the digital solutions you need. Contact us today, and let us help you navigate the intricacies of the Chinese e-commerce market.

References:

Top beauty review platforms in China: How to sell cosmetics in China

Beauty x Social: Top 6 Social Media Marketing Platforms for Skincare & Cosmetics in China