The demand for premium cosmetics products in China has long been driven by the perception of luxury goods as status symbols. If you think about it, the craze is also fundamentally fueled by the cultural influence of Chinese beauty standards.

These factors ultimately result in the gradual increase of luxury beauty product sales locally. So, it’s only natural for foreign brands to try and enter this business scene.

If you want to stand out from your local and international competitors, here are some insights on effectively selling your products within the high-end cosmetics market in China.

Overview of China’s Luxury Cosmetics Market

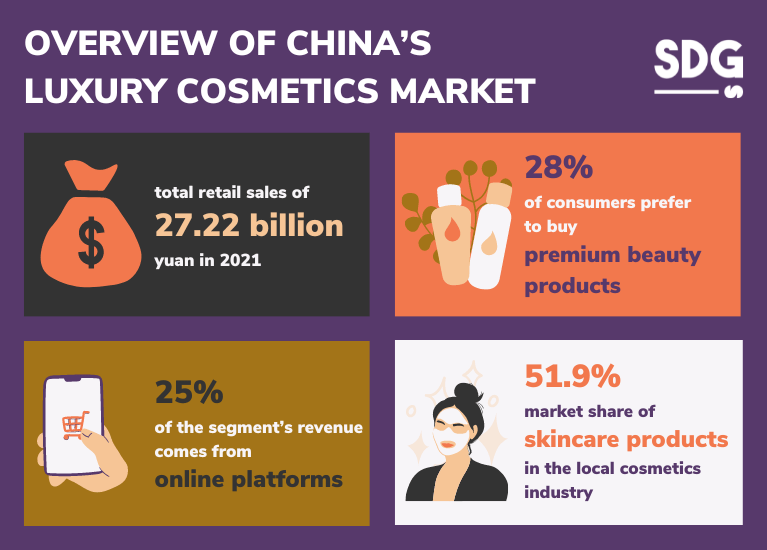

In a 2022 survey by Statista, around 28% of consumers in China’s cosmetics market prefer to buy premium beauty offerings. This percentage is much higher than well-known global markets in the cosmetic industry, like Australia and South Korea.

The local market’s growing preference for prestige cosmetics and beauty products has led Mainland China to accumulate a total retail sales of 27.22 billion yuan in 2021. While the main sales channels for these goods are predominantly from physical stores, 25% of the segment’s revenue now comes from online platforms.

Currently, skincare products overwhelmingly hold around 51.9% market share of the local cosmetics industry.

Why are Luxury Beauty Products Popular in China?

There’s no denying that the local beauty sector is overflowing with prestigious brands. Besides seeing these cosmetic products as a wealth symbol or emphasizing Chinese physical standards, the demand comes from China’s rapid economic growth.

It has led to an increase in the growing disposable income among the middle and upper classes. This financial ability enables more consumers to purchase from premium local and foreign cosmetics brands.

Chinese consumers also have a perception that luxury cosmetic brands offer higher quality and better results. And with globalization and the accessibility of international brands through e-commerce platforms, they are now more exposed to non-domestic products.

5 Key Trends in the Chinese Luxury Cosmetics Market

1. The Emerging Opportunities in the Premium Cosmetics Industry

Like other industries in China, the local high-end cosmetics market is highly segmented. Shaped by the changing needs of Chinese consumers, non-domestic brands have the chance to explore the emerging business opportunities this segment has to offer.

● Premium Skincare Products

The local skincare industry maintained stability despite market fluctuations from the previous pandemic. Thanks to the high demand from Chinese consumers, it has generated an impressive value of approximately 20 billion US dollars in 2023.

The continued revenue growth of skincare products can also be attributed to the growing market share of essences, face creams, and lotions.

Whether they’re from Chinese brands or not, it’s a no-brainer that these beauty items are often the first ones people buy, helping them stay popular even when the market is uncertain.

Meanwhile, the retail sales for sunscreen also did well last year, even when other skincare products didn’t.

To effectively leverage these trends, international brands should consider implementing marketing strategies like sample trials and establishing comprehensive service systems that blend offline and online shopping experiences.

● Luxury Make-up Products

Since the pandemic hit, Chinese luxury makeup is probably one of the most affected market segments in the cosmetics industry.

Although lipstick and foundation sales have dropped slightly, it still covers around 60% of this category. However, lately, primers have taken over the scene because people have been wearing masks for a long time and prefer lighter, more comfortable makeup.

When it comes to cosmetics in China, it seems that Chinese consumers are making quicker decisions on purchasing makeup products. They’re more likely to buy something soon after learning about it.

Non-domestic brands can leverage this consumer behavior by launching KOL collaboration ads, sharing product stories, offering free samples, giving discounts, and having excellent packaging to attract new customers.

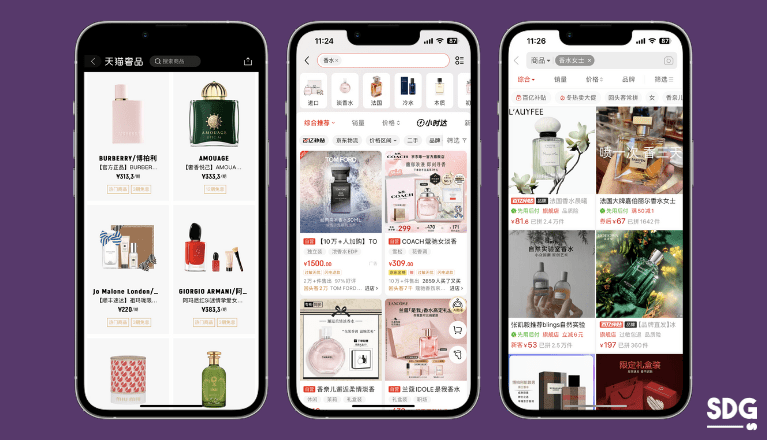

● High-end Perfumes and fragrances

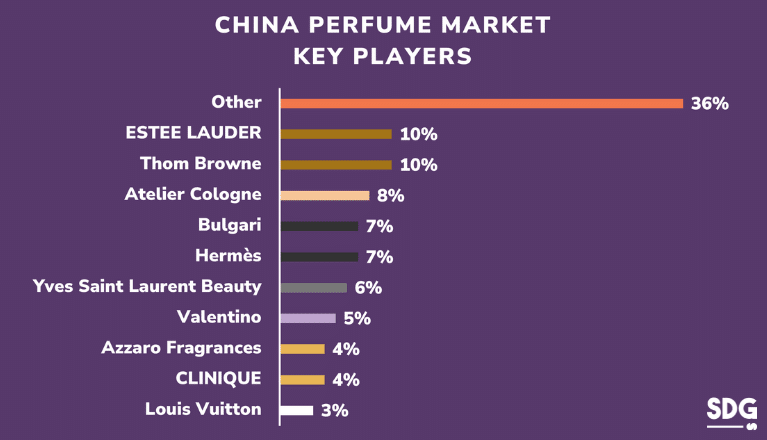

One look at China’s perfume market, and it’s clear that it’s dominated by products from international companies. In different Chinese social media and e-commerce channels, well-known brands like Estee Lauder, Hermes, and Valentino are leading the demand for this category.

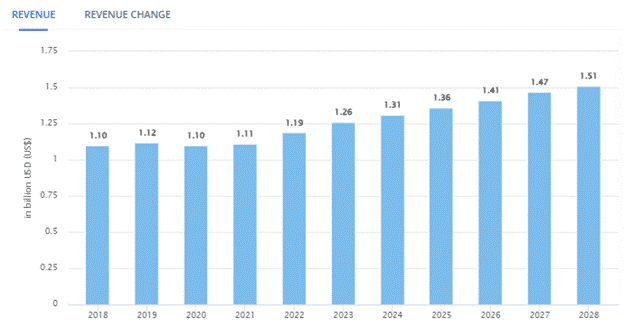

Although it’s not the biggest industry in the Chinese market, the rising demand for these cosmetic products allowed the segment to gain $1.36 billion in 2023.

Revenue of fragrance market in China 2018-2028 (Source: Statista)

The target market of luxury perfumes often prefers to buy products from department stores. However, the continuous transition of the Chinese market from offline to online has driven the segment to shift 28% of its revenue from virtual marketplaces and platforms.

Perfume choices that Chinese consumers like are mainly based on the type of scent. You also must consider that people have varied tastes and use perfumes for different occasions. It’s one of the reasons why new consumers are open to trying new scents and brands.

2. The Changing Demographic of Chinese Consumers

Like it or not, the Chinese market is now evolving, and the audience you’ll cater to will also change. In the luxury cosmetics market, two emerging groups are becoming key customers: the post-2000 demographic and male consumers.

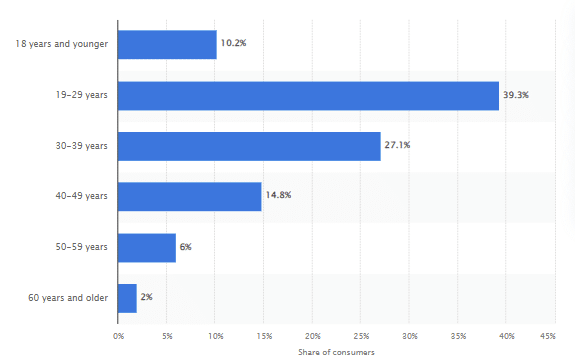

The new generation is swiftly entering the market and shaping the future of high-end beauty. In general, the primary consumers of cosmetics brands in China are mainly aged between 19 and 29 years old.

Most are students or young professionals with limited spending power, so they look for cosmetic brands that offer good value for money through online shopping.

Distribution of beauty and personal care market consumers in China (Source: Statista)

Although currently a smaller segment than female consumers, the growth rate of male cosmetics buyers is gradually increasing. Their purchases are often gifts, with high-end perfumes being popular for personal use and as presents. Skincare products are primarily for personal use, while makeup is more often gifted.

Male Chinese consumers tend to be more brand-loyal than the female population. Because of this, foreign brands selling new products may need to put more effort into marketing and advertising their offerings if they want to draw in this target audience.

3. The Continued Consumer Loyalty for International Brands

You may think domestic brands are your only competitors in the Chinese cosmetics market. However, that can’t be any further from the truth.

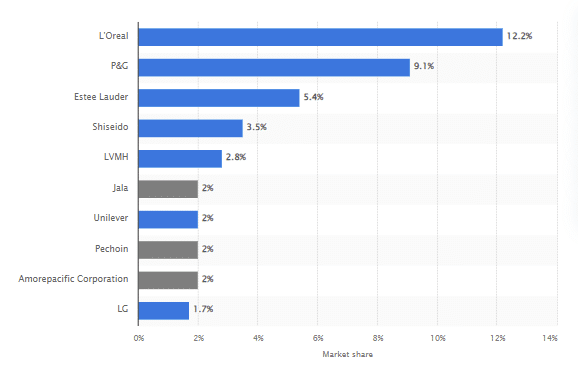

Based on recent data, a high percentage of popular cosmetics in China are from non-local brands like L’Oreal, P&G Beauty, and Estee Lauder. As you can see, most of these products came from Europe and the United States, which are often perceived to offer higher quality and effectiveness.

Locals also believe higher prices mean imported cosmetics undergo better research and development processes and use superior ingredients.

Leading cosmetics enterprises in China in 2021 (Source: Statista)

As you can see, foreign companies are also the dominating players in smaller Chinese luxury cosmetics market segments like the perfume industry.

Seeing how foreign products now account for a significant portion of sales in department stores and shopping centers in China, your competitive market research should include not only local cosmetics brands but also major global companies.

4. The Rise of Niche Brands for Young Consumers

It’s no secret that young Chinese consumers are rapidly becoming a large consumer base for luxury brands. In fact, one survey showed that 21% of Gen Z respondents are open to spending more than 16% of their income on luxury goods.

This interest is driven by a desire for new and unique products that are less known or available in China. Living an urban and global lifestyle, it has become more apparent that the younger generation is excited to explore and discover these non-mainstream cosmetic brands.

On top of that, the rapid development of e-commerce platforms has made a wide range of cosmetic brands available for the younger demographic. It has made overseas niche products more affordable as well.

And since online shopping goes beyond the Chinese market, regular consumers are now aware of global pricing and prefer not to pay higher on offline channels like physical stores.

Niche brands often provide novel experiences that appeal to younger Chinese consumers who pride themselves on their knowledge and research abilities. They also dedicate a lot of time to learning about beauty items on platforms like Red (Xiaohongshu).

5. The Demand for Products with Natural Ingredients

Traditional medicine has long been part of the Chinese culture, so it’s only natural that it has become one of the contributing factors for local consumers buying cosmetics products.

This cultural inclination towards natural remedies has led many local beauty shoppers to trust and value products that incorporate traditional herbal ingredients.

Photo by Monstera Production from Pexels

The trend was also driven by an increasing awareness among Chinese consumers about the potential health implications of harmful chemicals used in beauty products.

It has led to a preference for products with natural ingredients because they are generally perceived as safer and gentler on the skin.

Alongside health concerns, there’s a growing environmental consciousness among Chinese consumers. Natural products and sustainably sourced ingredients are considered more eco-friendly, aligning with the new consumer values of a modern beauty shopper.

How to Attract Consumers in China’s Luxury Beauty Market

Localize Your Brand for Chinese Consumers

New luxury cosmetics brands within the Chinese market should never forget that local consumers in China are savvy online shoppers. No matter how popular your product is, they’ll research everything about your brand before clicking on your promotions in any social or e-commerce channel.

Because of this, it’s crucial to localize your brand. This process includes having a Chinese domain name, hosting your website on local servers, translating content, and aligning your marketing strategies with cultural nuances.

You should remember that new products are being introduced daily in the Chinese high-end beauty sector, so staying ahead of the competition is critical. With your rivals continuously innovating, you must be faster and more imaginative.

Everything from your packaging to digital marketing assets should be eye-catching to make your products stand out. The goal is to create something that grabs attention and makes your product memorable to Chinese consumers across different platforms.

Build a Brand Presence on E-Commerce Platforms

With over 850 million Chinese consumers utilizing e-commerce channels for their shopping needs, it’ll be a missed opportunity if you don’t sell your cosmetics products through these online marketplaces.

The combined direct-selling and social media nature of these websites has made it easier for new brands to connect not only with potential consumers but also with other local businesses.

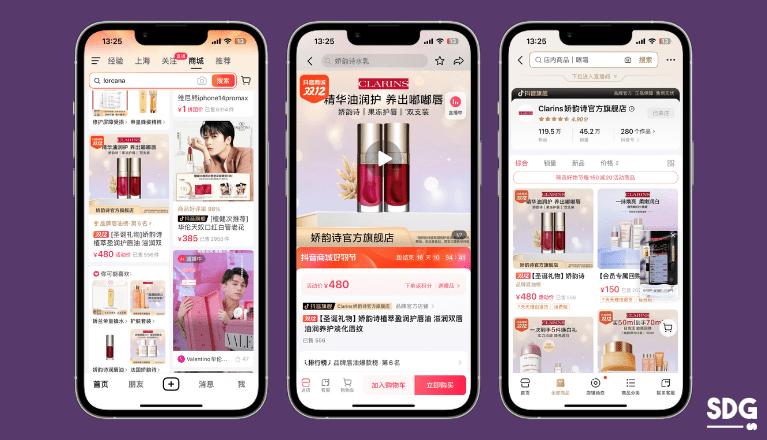

Avene on Taobao, JD.COM and WeChat China

For a luxury cosmetics brand aiming to establish a presence in China, it’s crucial to select the right platform based on the brand’s positioning, target audience, and product category.

Each of them has its unique audience and marketing tools, so you must do your research before picking among these options:

- Tmall and Tmall Global

Tmall is one of the largest e-commerce sites in China, mostly known for its brand authenticity and a broad range of beauty items.

This app allows brands to curate their digital storefronts and showcase products directly to their target consumers without leaving the platform.

- JD.com

Another option to consider is JD.com, a popular online marketplace focusing on cross-border trade and retail sales.

As a marketplace established in 1998, many international brands have seen significant growth on this platform. In the beauty sector, brands like Yves Saint Laurent Beauté, SK-II, Olay, Cetaphil, and La Roche-Posay have successfully managed to establish a foothold within the Chinese market.

WeChat’s strength lies in its integrated social commerce experience. It provides an avenue for new brands to engage with consumers through mini-programs, advertisements, and virtual product catalogs.

- Taobao

As of 2023, Taobao has 892 million monthly active users, 60% of whom are below 30 years old. Most of its users are men, contrasting with Tmall, where most are women.

Thanks to its user base, this platform highly suits brands looking to reach a younger audience and those aiming to foster creativity and individuality in their product offerings.

Promote Your Brand on Chinese Social Media Platforms

China has over 72% social media penetration rate, which means most of your potential consumers are already spending time on one of these local platforms. Not all apps you’ll encounter include the same features or audiences so here’s a breakdown to help you choose which one to use for your marketing efforts:

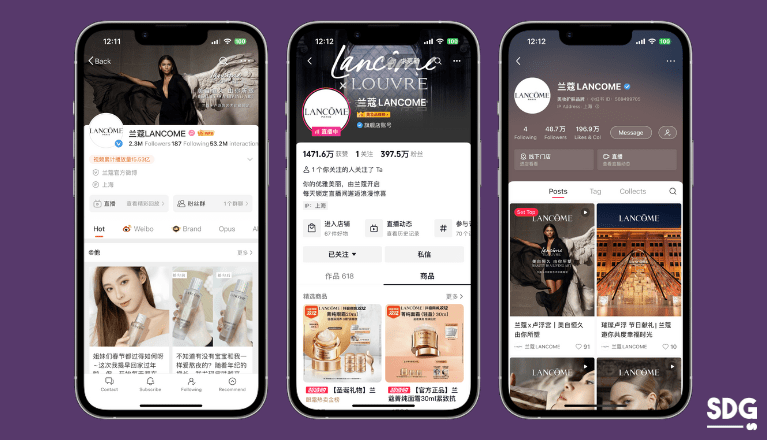

Lancôme on Weibo, Douyin and Xiaohongshu

It’s a micro-blogging platform similar to a mix of Facebook, Twitter, and Instagram. With an official Weibo account, luxury beauty brands can post visually appealing content and host online marketing events to increase brand awareness among Chinese consumers.

- Douyin (Chinese TikTok)

As a short-form video-sharing platform, launching marketing content through Douyin can help foreign marketers increase brand visibility. It boasts a high market reach, with over 730 million users every month, and a lot of them are under 30. So, it’s a great way to connect with younger audiences in China.

- Xiaohongshu (Little Red Book)

Xiaohongshu focuses on user-generated content around beauty and fashion topics, so it’s the perfect place to reach out to potential luxury cosmetics buyers.

You can collaborate with KOLs within the platform to develop a community around your brand. Besides that, engaging within this app can also enhance your product’s credibility by utilizing its commerce features for direct sales, including logistics and delivery support.

Utilize the Power of Key Opinion Leaders

KOLs are considered trustworthy by many Chinese consumers, with over 49% of surveyed respondents trusting their recommendations and reviews. These influencers can influence the opinions and preferences of their audiences, making them a powerful asset of any brand’s marketing strategy.

KOLs for Perfect Diary on Xiaohongshu

Look for KOLs who align with your brand image and values. While choosing influencers with huge followings can be advantageous, you must ensure they also possess credibility and a strong connection with their audience in the beauty and luxury industry.

With the rise of social commerce in China, KOLs now have more tools to tailor their content based on the needs of the brands they collaborate with. However, as we already said, different platforms in China cater to different demographics. So, no matter how popular your chosen KOL is, the collaboration won’t be effective if they’re targeting the wrong audience.

If you want a better and more accurate reach, launching campaigns on WeChat, Little Red Book (Xiaohongshu), and Douyin is the ideal option when promoting luxury cosmetics.

Participate in Marketing Calendar Promotions

Chinese consumers often commemorate special events in the country through gift-giving. If you want to generate brand visibility and revenue during these occasions, you must familiarize yourself with China’s unique calendar of festivals and shopping events.

Some important dates you must take note of in your digital marketing calendar include Chinese New Year, Singles’ Day (11.11), Mid-Autumn Festival, and Golden Week.

Judydoll for Spring Festival, Valentine’s Day & 520 Festival

Your digital marketing campaigns should be tailored to each Chinese festival date. It could involve special product launches, limited edition items, or exclusive promotions. Marketers must also ensure that the content resonates with the theme and spirit of the event being celebrated.

Chinese consumers often expect discounts and special deals during these key shopping dates. For better results during these festivals, we recommend offering exclusive promotions, bundle deals, or gift-with-purchase options to attract customers.

Challenges Foreign Brands May Face in China’s Luxury Cosmetics Market

Understanding the Chinese consumer needs can be critical for new foreign brands entering this market segment. As a marketer, you’ll quickly notice that the local preferences in cosmetics can vary significantly from Western markets in terms of product formulation, packaging, and marketing.

For instance, skincare products in China often emphasize whitening or brightening effects, which may be a low priority in Western countries.

Foreign companies may also find it challenging to navigate the specific regulations regarding cosmetics, including animal testing and ingredient approval. It’s crucial to stay updated with the constantly evolving regulatory landscape to ensure compliance and avoid penalties while doing business in China.

Last but not least, the Advertising Law in China is a framework that overseas brands must understand thoroughly before selling products in the local digital landscape. It requires a careful balance between creative marketing strategies and strict adherence to legal requirements. If not followed, it may result in censorship or banning.

Quick Q&A

How big is the cosmetic market in China?

After the height of the pandemic, China’s cosmetics industry experienced a remarkable rebound, reaching a value of 455.3 billion yuan in 2021. Looking at the trend reports, it significantly increased from the approximate 395.8 billion yuan recorded in the previous year. Since then, the sector has shown resilience and recovery, with projections suggesting it will grow to an estimated 516.9 billion yuan by 2023.

What is the luxury market forecast for China?

China’s luxury market is expected to continue its growth trajectory. By 2025, it is projected that Chinese consumers will account for nearly half of the global luxury market, potentially reaching or exceeding 40% of the total market share. The growing middle class and the rising interest of younger generations in luxury goods drive this growth.

How big is the beauty market in China?

In 2023, the Chinese beauty market is predicted to reach approximately $60.17 billion. According to some reports, experts expect it to grow annually by 5.03% between 2023 and 2028. The largest segment within this market is personal care, which in 2023 is projected to have a market volume of $25.52 billion.

Is skincare big in China?

Yes, skincare is big in China. In fact, it’s the leading country in the global skincare market. It’s the fastest-growing business segment in the local beauty and cosmetics industry, with an expected annual growth rate of 4.61% from 2023 to 2028.

Ready To Dominate The Chinese High-End Cosmetics Market? Get In Touch With Us Today!

The Chinese high-end cosmetics market presents an extraordinary opportunity for global brands to expand their consumer base. However, understanding China’s unique dynamics, cultural nuances, and regulatory landscape is not the easiest feat for a foreign company to conquer.

At Sekkei Digital Group, we understand the subtleties inherent to the Chinese market – including consumer behaviors and the ever-evolving trends that shape it. With our extensive expertise in this niche, we offer you the avenue to unlock your brand’s potential and secure a formidable position as a leading entity in the industry.

Get in touch with us today to leverage our expertise and insights. Our team is dedicated to helping you navigate this complex yet rewarding market, ensuring your brand resonates with Chinese consumers and stands out in a competitive landscape.

References:

2022 Digital Trend Report on China’s High-End Beauty Market

Prestige Brands to Lead China’s Beauty Market Growth in 2023

The Prestige Beauty Market in China