The Chinese market is widely known as a “Mobile First” industry, where over 1.08 billion locals use their phones to access the internet. Among these users, 884 million are active consumers ready to make online purchases.

With the country emerging as a cashless society, social and commerce platforms in China now accept mobile payments to optimize every user’s online shopping experience and streamline business transactions.

Today, Alipay and WeChat Pay are the dominating players in China’s mobile payment market. In this post, let’s explore how these two smart payment giants can help your business manage your target market’s consumer journey.

What is WeChat Pay Used For in China?

WeChat Pay app is a digital payment solution owned by Tencent, the same company that launched China’s largest social media platform. Since it presents itself as more than just a payment app, it’s not surprising that it has garnered 1.133 billion users over the years.

As you know, this digital wallet is deeply integrated into the WeChat social media app. Because of this, Chinese citizens often use it for personal online transactions like transferring money to friends and family or paying bills.

Although it started as a popular instant messaging platform, it has a full-scale online ecosystem, including food delivery, e-commerce stores, and taxi-hailing services. All of these in-app purchases can be settled through a WeChat Pay account.

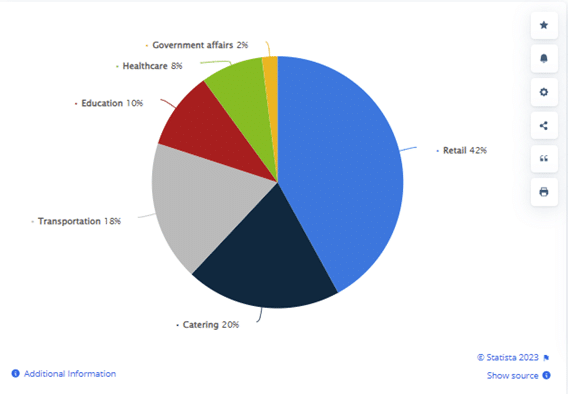

On top of that, at least 42% of people who use WeChat Pay are utilizing its QR codes as a payment method for retail purchases.

This high usage rate mainly stems from the fact that this mobile e-wallet is linked to WeChat’s mini-programs, which are small apps within the main app, often used by businesses for e-commerce.

Breakdown of WeChat Pay QR Code Transactions (Source: Statista)

How to set up WeChat Pay for your business in China?

Although WeChat Pay is a standalone mobile payment platform, you can only use it for your brand if you have an official business account. Depending on your products and services, you may also need specific licenses to operate legally in China’s digital landscape.

WeChat Pay Website Homepage

When you create an official WeChat account, you can choose between a Subscription or Service business profile. The latter is more suitable for brands that intend to integrate WeChat Pay for e-commerce payments.

For the registration process, foreign marketers must provide company information and documentation for the platform to authenticate their business identity.

After this verification, you can apply for WeChat Pay on the Official Accounts Platform. You’ll be asked to provide details like expected transaction volumes and bank account information.

Besides the WeChat app, some major online marketplaces that accept mobile payments from this e-wallet service are JD.com, Pinduoduo, VIP Shop, and Kaola. If you want to maximize the potential of WeChat Pay for your business, we recommend partnering with these platforms for a simplified integration process.

Once you have a verified merchant account in this mobile payment system, you’ll be given access to managing financial settlements or refunds and viewing transaction records.

Is WeChat Pay safe?

WeChat Pay uses advanced encryption technologies to safeguard transaction data. It means sensitive information like bank account details and personal data are encrypted during transmission and storage.

Tencent, the parent company of WeChat, adheres to Chinese data protection laws, including strict user data privacy and security guidelines.

Photo from Pixabay

Like other mobile payment platforms, WeChat Pay users must undergo a real-name authentication process. It typically involves linking a bank account and verifying identity, which helps prevent fraud and unauthorized usage.

For transactions and account access, WeChat Pay often requires two-factor authentication. You may not know, but this feature adds a security barrier beyond just providing a password.

What is Alipay Used For in China?

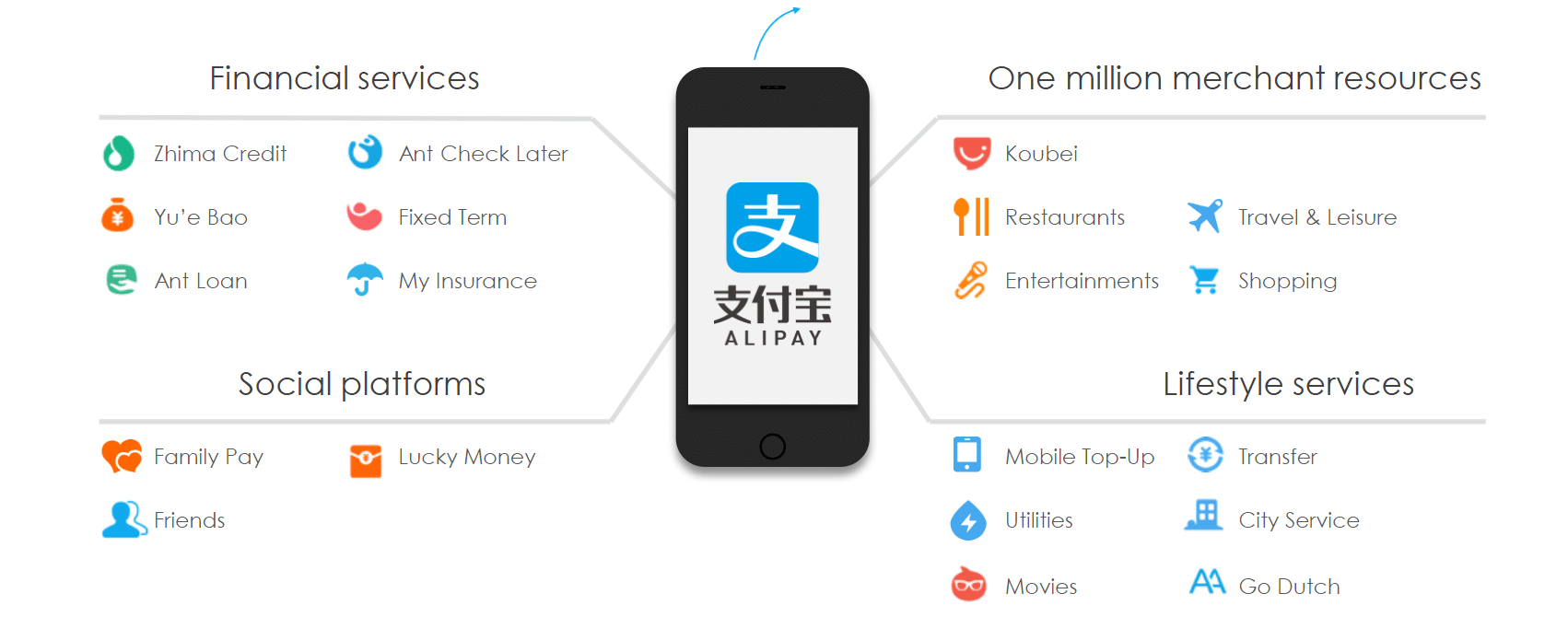

Founded in 2004 and owned by Alibaba, the Alipay app is China’s most extensive mobile payment option. Currently, the platform has over 652.4 million monthly active users. Because of its high local usage rate, it’s in firm competition with major services like WeChat Pay and QQ Wallet, both by Tencent Holdings.

Alipay payments are extensively used for peer-to-peer money transfers, allowing individuals to easily send and receive funds from friends and family, even without traditional bank accounts.

On top of that, paying through an Alipay account is also widely accepted on numerous e-commerce sites, particularly those within the Alibaba group, like Taobao and Tmall.

Integrating Alipay through these social commerce platforms can elevate the online shopping experience of your potential consumers with its secure and efficient transaction capabilities.

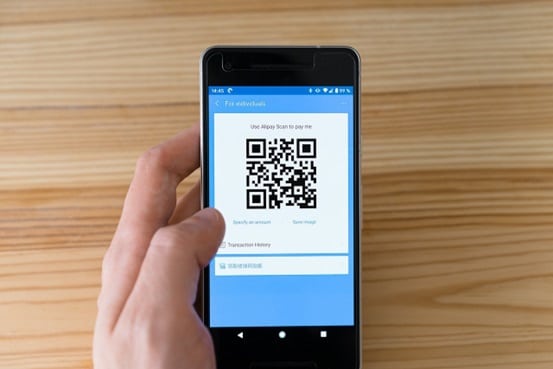

Beyond China, Alipay’s reach extends to over 300 cities globally, with a user base exceeding 800 million. You can also see it being used in offline settings like stores, restaurants, and other commercial establishments, where customers can purchase by scanning QR codes.

Much like WeChat Pay, the app’s functionality goes beyond online retail purchases and extends to transportation services, enabling users to book and pay for taxis and train tickets. Additionally, it caters to various lifestyle needs, such as booking movie tickets, reserving hotel stays, and ordering food delivery.

With these many market sectors accepting Alipay payments, it has become more apparent how important the app is in facilitating a seamless and modern lifestyle in China.

How does Alipay work for your business in China?

First, you must create a merchant profile using your existing Alipay account. The platform may ask you to provide company and financial information, such as proof of your business registration.

Once verified, the next step is to integrate Alipay’s payment gateway into your financial and operational systems. For physical storefronts, this process typically involves scanning Alipay QR codes. Meanwhile, online businesses can integrate mobile payments through the checkout page on their websites or any third-party social commerce apps.

Alipay Website Homepage

The transaction system within the Alipay app is engineered for optimal real-time efficiency. It facilitates immediate confirmations of digital payments, significantly enhancing customer satisfaction and contributing to more effective inventory management.

Beyond leveraging platforms that accept Alipay payments, businesses can utilize the app’s financial management tools for detailed reporting and analytics. You can count on it for insights into sales patterns, refunds, and customer payment behaviors, which can help marketers make informed financial planning decisions and market analysis.

Is Alipay safe?

You don’t have to worry about security if you’re using Alipay to transfer money or utilizing its payment function for your business transactions because all communications within the app are encrypted. It ensures that your data is protected during transmission.

The local payment app also implements a vigilant risk monitoring system that scans your wallet for unusual activities every 30 seconds, helping identify and address potential threats immediately.

Besides all that, the Alipay wallet incorporates two-factor authentication. It means that in addition to a password, you must verify your identity using biometric data, like a fingerprint or facial recognition, making unauthorized access significantly more difficult.

Alipay vs WeChat Pay: How Different Are They?

Before deciding between WeChat Pay vs Alipay, you must understand the unique features and advantages of both platforms that can significantly impact your business. Here’s a quick breakdown:

1. Social Media & E-Commerce Integration

Although both WeChat Pay and Alipay are widely used in China, they cater to different social media and e-commerce platforms.

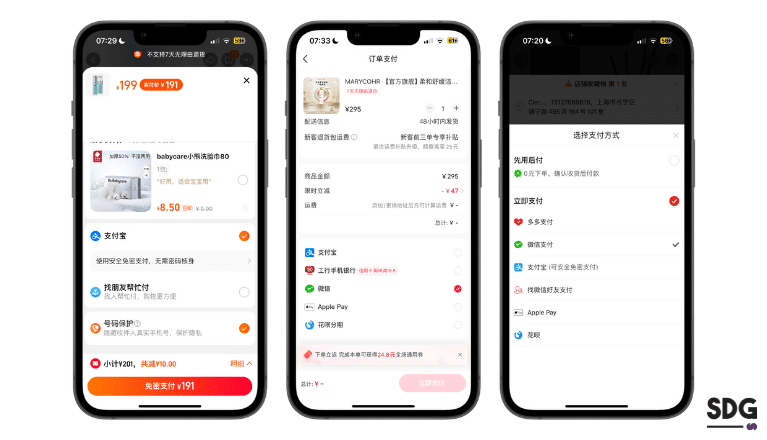

As part of the Alibaba Group, it’s a no-brainer that online marketplaces like Taobao and Tmall are accepting Alipay to help their users pay vendors within the system. It’s designed for a more e-commerce-centric experience, with an integrated review system ideal for businesses seeking user-generated content.

Unlike WeChat Pay, Alipay has no significant presence within China’s top social media apps. Its approach is more transactional and less about integrating social interactions with payment processes.

Meanwhile, WeChat Pay has its own social platform. Thanks to this, it’s available to over a billion users who can conduct transactions without leaving the app, whether it’s paying for services, sending money to friends, or participating in social media campaigns launched by your brand. This super app also hosts mini-programs, which are basically sub-applications within its ecosystem that allow for e-commerce activities. Brands and businesses can set it up to sell products directly within the platform while using WeChat Pay as the payment method.

Although WeChat Pay is unavailable in Alibaba-related e-commerce mobile apps, it’s an acceptable payment platform on JD.com, Pinduoduo, and Little Red Book.

Payment methods on Taobao, Little Red Book and Pinduoduo

2. User Experience

As mentioned, WeChat allows a frictionless transition from social activities to financial transactions. Through this, brands can leverage unique opportunities to engage customers within their social ecosystem.

As a payment method, it is designed to be quick and user-friendly. Transactions are often made by scanning QR codes online and in physical stores.

Businesses can even use WeChat Pay to develop loyalty programs. They can try offering rewards and discounts directly through the payment platform to increase customer retention and boost sales.

AliPay users experience the same level of convenience when it comes to payment services. The only difference is that it has a better financial ecosystem, including the ability to manage bank cards, savings, loans, and investment products within the app.

3. Market Reach and Demographics

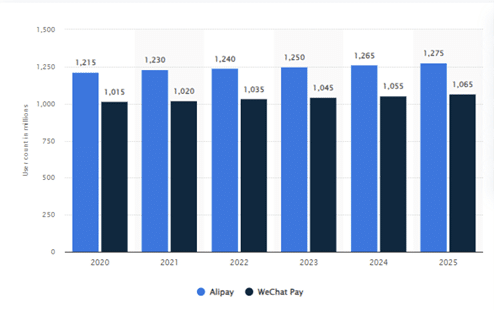

Some may think that WeChat Pay has a broader user reach than Alipay because of its social media integration. However, if we look at the official numbers, the latter still leads with a predicted 1.2 billion users utilizing its payment system for virtual transactions by the end of 2023.

Users of Alipay and WeChat Pay in China (Source: Statista)

While WeChat Pay appeals to a wide range of age groups, its integration into a social media platform makes it especially popular among the younger population who use it for communication and commerce.

Alipay’s dominating age group also ranges between 25 and 24. However, it has a broader appeal across older user demographics who may not be as engaged with social media but are active in online shopping and use financial services.

Besides online purchases, this local e-wallet service attracts users interested in its comprehensive services, such as wealth management, insurance, and credit products.

4. International Payments

Foreign businesses looking to attract Chinese consumers traveling abroad can leverage WeChat Pay and Alipay effectively, given the widespread popularity and trust these platforms enjoy among locals.

WeChat Pay has the advantage of letting businesses connect with customers through the biggest local social media app. This capability alone can help foreign marketers advertise to Chinese tourists directly on their phones and even offer special deals if they pay using the platform.

On the other hand, Alipay is great for shopping because it’s tied to Alibaba. It helps tourists get tax refunds quickly on their shopping when they’re visiting different countries. Businesses can also use it to put out ads and coupons to attract Chinese travelers.

WeChat Pay vs Alipay: Which Should You Choose For Your Business?

For businesses in China, the choice between Alipay and WeChat Pay depends on their specific goals and customer engagement strategies. If a company wants to capitalize on social engagement and integrate commerce within a social context, WeChat Pay provides the necessary tools and user environment.

Its strength lies in fostering community and conversation around brands and products, which can be incredibly powerful for customer retention and word-of-mouth marketing.

On the other hand, Alipay shines in scenarios where the business model is heavily centered around e-commerce and financial services.

Its ecosystem offers a user experience conducive to shopping and managing finances, which can appeal to a demographic that values convenience in online transactions and financial management.

Quick Q&A

Can you use WeChat Pay without a Chinese bank account?

Traditionally, WeChat Pay required a Chinese bank account for full functionality. However, recent updates have enabled international users to use WeChat Pay by linking a foreign credit card.

This feature is mainly aimed at tourists visiting China. However, the functionality and user experience might be limited compared to having a Chinese bank account linked. You must also remember that debit cards are not allowed for this process.

Can you use Alipay without a Chinese bank account?

Similar to WeChat Pay, Alipay also requires a Chinese bank account. However, Alipay has introduced new options for international users. Tourists can now use Alipay by loading money onto a prepaid card within the app. This feature, known as the “Tour Pass,” allows them to use the app for a limited time.

Can you use WeChat Pay and Alipay outside China?

Yes, you can use WeChat Pay and Alipay outside China. In fact, many Chinese tourists utilize these apps for online payments when they’re traveling abroad.

Your Trusted Digital Marketing Partner in China!

The decision between Alipay and WeChat Pay hinges on brand strategy. At the end of the day, understanding the shopping habits of your target market in China is critical to selecting the right payment system.

You may also want to read:

At Sekkei Digital Group, we understand the subtleties inherent to the Chinese consumer market – including user behaviors and the ever-evolving trends that shape it. With our extensive experience, we offer you the avenue to unlock your brand’s potential and secure a formidable position as a leading entity in the industry.

We can help you utilize the power of modern digital marketing, from choosing the right online payment services to maximizing its features to attract new consumers. Contact us today, and let’s start working together!

References:

WeChat Pay vs. Alipay: Which Payment Apps Do You Need in China?

Alipay, what it is and how it works