The conclusion of the previous pandemic has noticeably led to rising demand and consumption within the Chinese fragrance market. With local headlines reporting positive market insights and growing perfume sales, international brands are becoming more eager to seize this opportunity.

However, it’s worth noting that the Chinese market is highly segmented. For foreign marketers to succeed, they must develop a strategy that appeals to local consumer preferences. If not, it’s easy for a product to get lost in the sea of Chinese perfume brands.

In this post, we’ll explore the ins and outs of China’s fragrance market and provide valuable insights on how international brands can stand out amidst the highly competitive landscape.

How big is the perfume market in China?

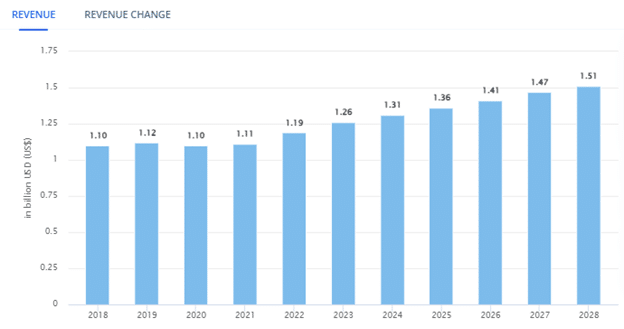

In 2023, China’s perfume market reportedly reached $1.26 billion. Its rapid expansion has allowed the industry to generate a compound annual growth rate of 21.4% from 2016 to 2021 data.

While the local fragrance sales only cover 4.1% of the global market, the Chinese perfume industry shows ten times more growth than other countries. This consistency especially highlights this lucrative market as a potential key player globally in the fragrances segment.

Revenue of fragrance market in China 2018-2028 (Source: Statista)

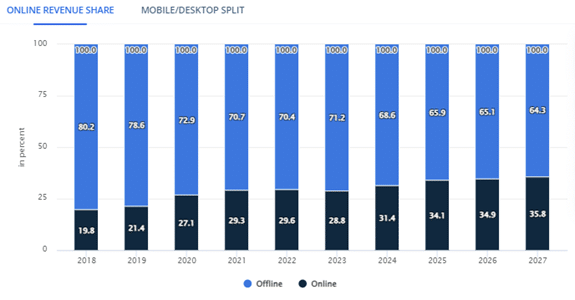

Much like Western markets, most fragrance brands sold in the local business scene fall under the luxury goods category. Because of this, it’s only natural that over 71% of its sales come from offline stores.

However, the continued development of China’s digital landscape and the rising social media penetration rate among local shoppers have led the market to acquire more than 28% of its revenue from online channels.

Chinese Fragrance Market – Online vs Offline Revenue (Source: Statista)

If Chinese consumer confidence in fragrances continues its upward trajectory, the per-person revenue of perfume in China could reach $1.06 by 2028. You may not know, but a higher per-capita record means that the consumer levels in the local fragrance industry will continue to rise in the next five years.

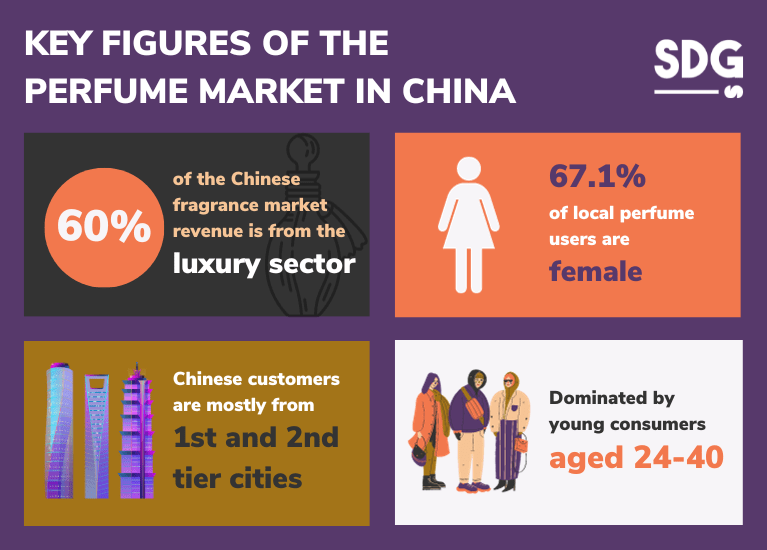

Key Figures of the China Perfume Market

When launching digital marketing campaigns in the Chinese market, it’s crucial to take notes on the industry’s consumer behavior and relevant trends. For better results, it’s vital to conduct a market study and evaluate the strategies your competitors are executing.

Here are a few details about the local fragrances market that may help you to develop more effective marketing strategies to resonate with Chinese consumers:

- 60% of the Chinese fragrance market revenue is from the luxury sector.

- 67.1% of local perfume users are female Chinese consumers.

- The local fragrance industry is dominated by young consumers aged 24 to 40.

- Chinese customers fond of buying perfumes are mostly from first and second-tier cities.

7 Marketing Tips for Foreign Brands in the Chinese Perfume Market

1. Localize your Brand for the Chinese Consumers

One of the first steps non-domestic brands must take is to localize their products and all the accompanying promotional content. Chinese consumers may be a fan of luxury goods, but it’s worth noting that these savvy shoppers are also wary of new businesses.

Local consumers tend to do extensive product research when buying perfume from non-Chinese brands.

It may seem tricky, but you can take advantage of this consumer behavior by giving them the information they want through digital mediums, like the brand’s website or social media profiles. You must also ensure that everything is in the local language and aligns with the Chinese culture and its market nuances.

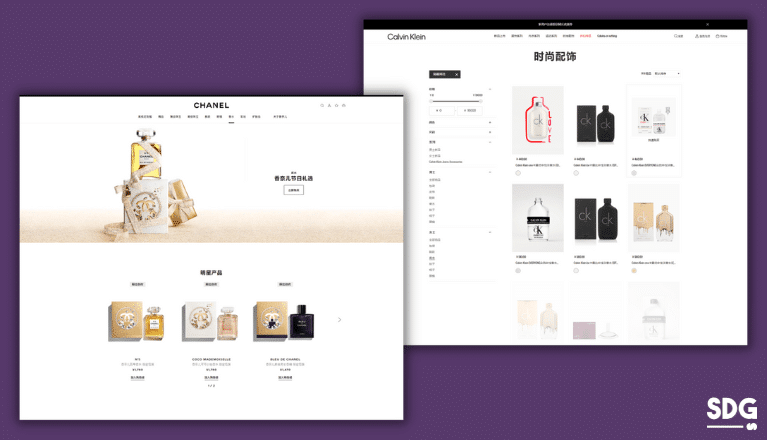

Take big brands like Calvin Klein and Chanel as examples. They have locally hosted websites with marketing content specifically for local audiences. This strategy generated more brand visibility and gave them more credibility and authenticity in the eyes of Chinese customers.

Always remember that brand localization goes beyond mere translation. When marketing perfume brands, one of the best methods to integrate Chinese culture into your promotions is by making special campaigns or limited edition products for local holidays and festivals.

2. Conduct Search Engine Optimization on Baidu

China’s fragrance industry is a competitive market, so having your website properly optimized for local search engines can be a driving force to increase traffic for your brand and generate potential sales.

In China, around 677 million users access Baidu to search for information and products to buy. This popular search platform handles approximately 6 billion queries daily, making it a significant part of the country’s digital landscape.

As we already discussed, local consumers tend to be more suspicious of unknown and non-Chinese perfume brands. So, if they hit enter on Baidu, you’d want them to see your content at the top of the platform’s search results to boost the brand’s visibility and make it appear more credible.

Your brand will need a solid Baidu SEO and SEM strategy, like conducting proper keyword research, optimizing content to generate organic traffic, or utilizing the platform’s advertising options.

3. Open a WeChat Official Account

Local social media platforms are the holy grail of digital marketing strategies in China. And as the largest super app in today’s market, WeChat serves as a powerful tool to introduce new scents to savvy Chinese customers.

With over 1.67 billion monthly active users in China, marketing on this social channel can help you reach more potential customers interested in fragrance brands. Although WeChat started as a messaging platform, it now has a wide range of marketing tools any brand may find useful in enhancing its visibility and recognition within the local market.

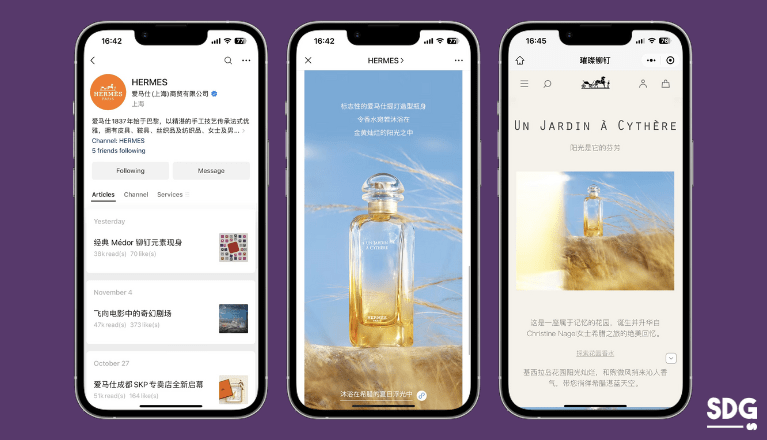

Hermès’ WeChat account and an article about their perfume linking to their WeChat Mini Program

With an official WeChat account, foreign businesses can have their own brand pages within the platform. They can utilize this feature to communicate directly to their intended audience.

Through WeChat, you can share engaging and informative content. It can include the brand’s history, the perfumes’ unique aspects, stories behind your scent library, and user testimonials. Visual and interactive content like videos and infographics can be particularly effective.

Besides launching ads, the app also features a built-in e-commerce platform that allows users to make purchases directly within the app.

Linking the brand’s product catalog to the WeChat store can streamline the consumer purchasing process without leaving the app.

4. Promote your products on Weibo

Besides WeChat, Weibo has a massive user base that perfume brands can leverage for effective marketing campaigns. This platform offers a unique blend of microblogging, social networking, and media-sharing features that can be utilized to reach a vast audience in China.

Foreign marketers can post updates, product launches, and brand stories through a verified Weibo account.

Like Twitter, Weibo marketing thrives in interactive campaigns and user-generated engagements. We highly encourage engaging with the audience by responding to comments, messages, and feedback. This strategy can help you foster a dedicated community and provide valuable insights into customer preferences.

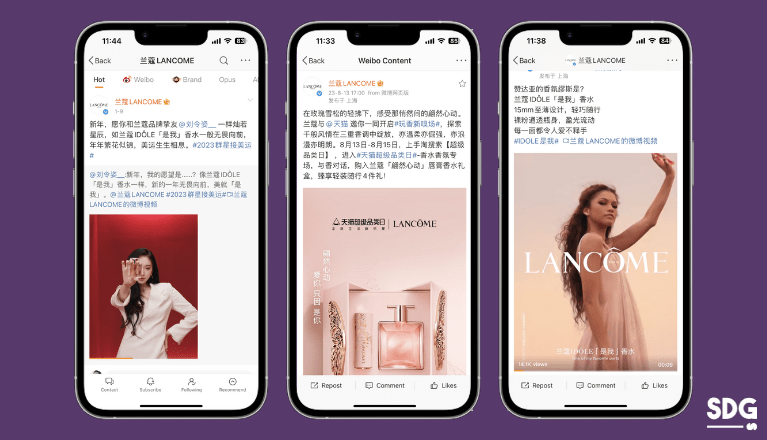

Lancôme perfumes promotion posts on Weibo

You can hop on trending hashtags or create your own to help consumers find everything related to your perfume brand more easily. If your brand has the budget, take advantage of Weibo’s advertising solutions, such as display ads, promoted feeds, search engine promotions, and fan headlines, to introduce your scent library to a broader audience.

5. Utilize Douyin to reach more Chinese consumers

For those who don’t know, Douyin is the Chinese version of TikTok. This app boasts over 750 million daily active users in China, 33% of which are young consumers under 26 years old.

Since this app features short-form video content, fragrance brands can utilize its functions to share product reveals, behind-the-scenes footage of how the perfumes are made, and visually appealing demonstrations of the scents.

Posting videos on Douyin can also be good material to introduce the market to international flavors and fragrances uncommon in the local market.

Valentino perfume promotion on Douyin linking to their Douyin store

Douyin is also a social app accompanied by a built-in e-commerce integration. It allows linking products directly into the content and leading the consumer to the brand’s in-app store.

This feature allows customers to enjoy seamless purchasing while brands tap into the market’s impulse buying behaviors.

6. Work with KOLs on Little Red Book

Little Red Book is a social media and e-commerce platform popular among young and urban Chinese consumers. It’s known for its authentic user-generated content and trusted product reviews.

Like Douyin, most users of Little Red Book are based in tier-one cities. They also boast a higher education level and have considerable disposable income.

It’s the perfect place to sell fragrances because this social commerce app is mainly dominated by products related to lifestyle, luxury, fashion, and cosmetics.

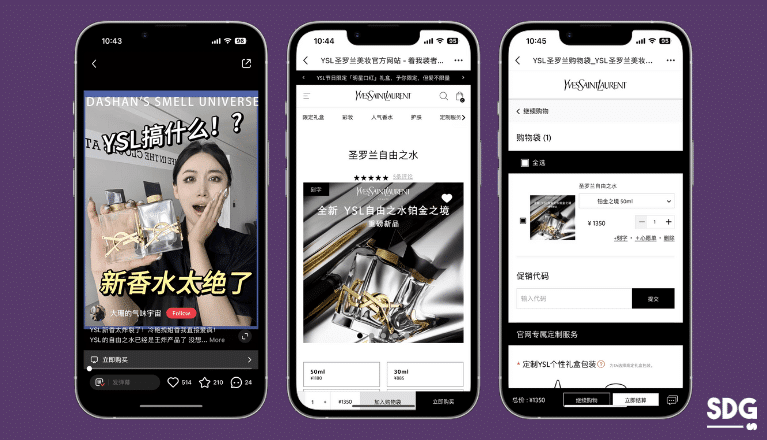

KOL post on Xiaohongshu for Yves Saint Laurent perfume linking to the brand’s store

New perfume brands looking to market their products in XiaoHongShu can also consider collaborating with the platform’s KOLs. These influencers have massive followers on the platform and can influence the general opinion about your brand.

The platform’s algorithm prioritizes detailed and engaging content, making it an exceptionally efficient tool for influencer marketing. This approach not only elevates brand awareness but also significantly boosts sales.

7. Amplify brand presence on E-Commerce Platforms

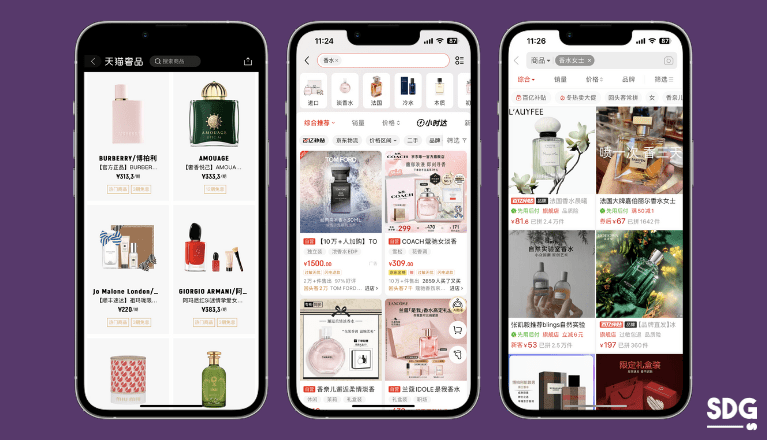

Besides the social commerce platforms we discussed above, two of the dominating online marketplaces in China are TMall and JD.com. These apps are excellent selling channels with features and algorithms to help you reach B2B and B2C target audiences.

TMall, in particular, even has a section called “Perfume Route.” This feature allows the proper facilitation of cross-border trade for global fragrances and perfumes.

Meanwhile, brands can also consider selling their products on China’s second-largest e-commerce channel, JD.com. Although the platform was initially known as a marketplace for home appliances and electronics, it has since expanded its offerings to lifestyle-related goods like cosmetics, clothes, and fragrances.

Perfumes on Tmall, JD.COM and Pinduoduo China

For niche fragrance brands targeting low-tier cities in China, Pinduoduo’s group buying model can be handy in reaching that audience type.

Its e-commerce user base primarily consists of price-sensitive consumers, so incorporating your marketing campaign with discounts, gifts, or limited-time offers can be a good way to spread the word about your brand in this app.

Top Trends in China’s Perfume Market

● The Rise of Home Fragrance Market in China

The previous pandemic has forced many Chinese consumers to work from their living spaces. This incident has increased sales of interior-related goods, including home fragrances.

Room scents are considered luxury items. And with the increasing disposable income among younger generations, these fragrances will continue to get popular.

● The Battle of Commercial vs. Niche Fragrances

When you think about perfumes, you’d think about typical scents from luxury brands. Most Chinese people view these products as a symbol of their economic status, so it’s natural that they dominate the market.

However, Gen Z shoppers in China beg to differ. The evolving preferences of these young consumers have led them to prefer niche fragrance brands over “old-fashioned” scents.

You’ll notice that niche brands appeal to the specific tastes that locals may relate to. Most will try to use traditional ingredients, woody aromas, or other flavors that may stir up childhood memories in particular audiences.

● Growing Demand for High-end Perfumes

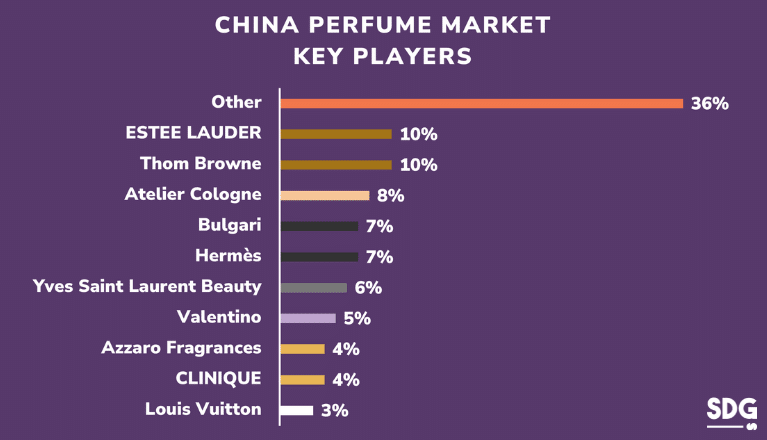

Foreign fragrance brands are not new in the local market. In fact, if you look at social and distribution channels in China, you’ll see familiar international names like Estee Lauder, Hermes, Valentino, and many more.

Key Players in the Chinese Perfume Market (Source: Statista)

Although Millenials and Gen Z consumers have obvious preferences for niche fragrances, the demand for luxury perfumes is still dominant and will continue to rise in China.

● Male-oriented Perfume Brands

In 2021, it was reported that the sales of male beauty products in China had reached a whopping 713 million yuan. Industry experts expect its revenue to increase significantly by 2025, signaling a great business opportunity for local and international brands.

Well-known male-oriented perfume brands have already noticed this positive market outlook. As a matter of fact, Hugo Boss is now widely available in China through several e-commerce platforms.

● Young Chinese Consumers Seeking Customizable Scents

Millennials and Generation Z are increasingly becoming key players in the local perfume sector, bringing distinct preferences and demands.

These consumers are not only willing to pay a premium for unique fragrances but also expect a higher level of service personalization. It’s also the reason why they often gravitate towards niche brands.

In their pursuit of individuality, Millennials and Gen-Z extend their desire for customization beyond perfume scents. They also consider distinctive elements such as the color, the design of the bottle, and various packaging options, making each product uniquely theirs.

Quick Q&A

What scents are popular in China?

Popular perfumes in China often include brands known globally for their quality and allure. These include Chanel, Dior, and Gucci, which offer a range of sophisticated and elegant scents.

For local brands, popular scents are subtle and sophisticated, reflecting the cultural preference for less overpowering fragrances. Floral notes, especially those of jasmine, osmanthus, and rose, are widely favored. Fresh and light fruity scents are also preferred, particularly among younger consumers.

How to sell perfume in China?

You can sell perfume in China by creating virtual stores on popular e-commerce platforms like Tmall, WeChat, JD.com, or Little Red Book. These online marketplaces not only have a massive user base but they’re also equipped with marketing tools that’ll help you amplify the brand’s visibility in the local market.

How to import perfume to China?

You can import perfume to China by selecting the right selling channels, whether through online e-commerce platforms or other distribution methods. Foreign brands must also abide by China’s required product standards and regulations to avoid any issues during the import process.

Ready To Dominate The Chinese Perfume Market? Get In Touch With Us Today!

The Chinese perfume industry is highly competitive. Not only are you competing with local brands, but you’re also in the presence of many massive foreign fragrances with solid credibility and recognition in the local market.

Don’t let these challenges hold your business back! At Sekkei Digital Group, we understand the specific complexities of the local perfume market–including consumer behaviors and the evolving trends that shape it. With our extensive expertise in this niche, we offer you the avenue to unlock your brand’s potential and secure a formidable position in the industry.

Whether it’s crafting compelling advertising campaigns, utilizing social platforms, or collaborating with relevant KOLs, we have all the digital solutions you need. Contact us today, and let us help you navigate the intricacies of China’s fragrance business scene.

References:

Chinese perfume industry

Fragrances – China

A Guide To China’s Fast-Evolving Fragrance Market In 2023