Last Updated on June 11, 2024

The Chinese gaming market is the second largest in the world, ranking closely next to the United States. With its growing user base of 720 million, it’s no wonder international companies are eagerly finding ways to make their games available in the country.

Before you decide to break into China’s gaming market, it’s worth noting that it’s a highly regulated industry. From acquiring new video game licenses to navigating regulations implemented by the Chinese government to curb video game addiction, entering this market can get overwhelming.

Lucky for you, we’re here to discuss the industry’s unique requirements and share insights on how to promote online games in China more effectively.

How big is the gaming market in China?

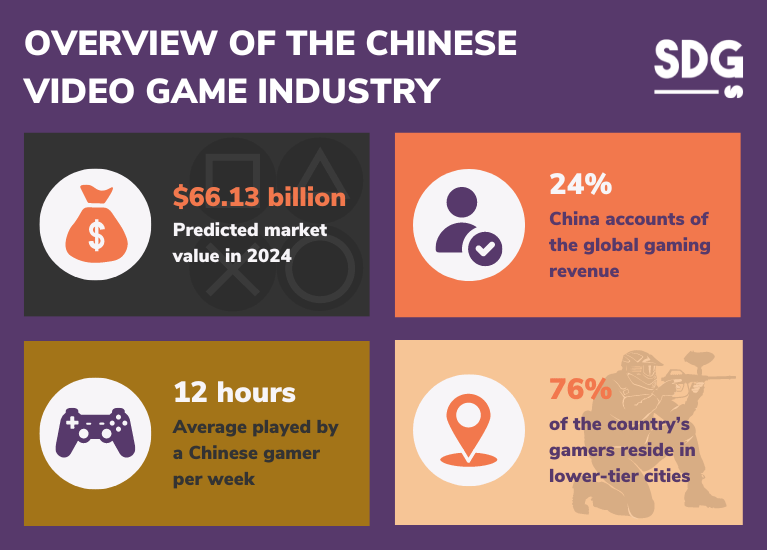

For starters, the Chinese video game industry has a predicted market value of $66.13 billion in 2024. Some key factors driving the sector’s rapid growth are the widespread adoption of the Internet, increased mobile device usage, and the continued popularity of e-sports in the country.

China now makes up more than 24% of the global video game industry revenue. This isn’t shocking, given a study by Niko Partners, which found that gaming is a top choice of activity among Chinese gamers. On average, gamers in China spend at least 12 hours a week playing video games.

The flow of online gaming revenue in the Chinese market is not equal in all cities. Around 30% of the overall market profits come from China’s major cities (Tier 1 and 2), but 76% of the country’s gamers reside in low-tiered areas (3 to 5).

Although mobile apps dominate today’s Chinese gaming industry, the market thrives in different mediums like PC games, home console games, and web-client games. The high penetration rate of social media apps within China’s digital ecosystem also drives the growing influence of mini-games.

These sub-gaming applications are integrated into local social media platforms, making them an effective tool to attract new audiences interested in mobile gaming. In 2023, this segment alone managed to garner a massive revenue of 20 billion yuan.

The continued development of modern cable networks allows local download speeds to reach up to 100 Mbps. Thanks to these technological advancements, the revenue streams in China’s gaming industry are expected to grow even more in the coming years.

Local players at the 20th China Digital Entertainment Expo & Conference (Source: China Daily)

Moreover, the cloud infrastructure in China now includes advanced computing, storage, and networking technologies. As these cloud computing resources are known to be cost-effective and easy to maintain, they’ll surely be ideal for various game developments that may enter the Chinese gaming market in the future.

What is the most popular game genre in China?

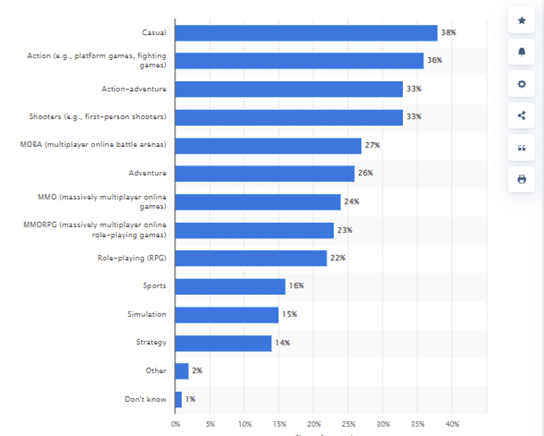

Looking at the revenue generated in each medium, it’s safe to say that the Chinese gaming market is a highly segmented industry. As more international companies enter the scene, you can get ahead of the competition by knowing which type of game local gamers prefer.

Preferred video game genre in China as of December 2023 (Source: Statista)

● Casual Games

The video game industry has this general image of being exclusively strategic and action-packed. However, did you know that most Chinese gamers prefer playing casual gaming apps?

These games have simple controls and rules. You also don’t need complex skill sets to accomplish milestones in the game.

Perfect examples of these applications are virtual board games like Ludo King, dice games, and puzzles. Many of these mobile games involve multiplayer modes, where it’s possible to solve puzzles with friends or randomly matched users.

Source: Tech Radar

● First-Person Shooters (FPS) Games

FPS games enjoy a significant following worldwide, and China is no exception. Video game titles like CrossFire and Call of Duty have seen considerable success in the local market.

CrossFire, in particular, has been a staple in China’s FPS scene, primarily due to its early market entry and adaptation to local preferences.

Despite their popularity, FPS video games often face stiff competition from other genres that align more closely with Chinese gaming preferences for social interaction and strategic gameplay.

Source: CrossFire QQ Page

● Multiplayer Online Battle Arena (MOBA) & Battle Royales

MOBA and Battle Royale games are among the most popular and lucrative genres in the Chinese gaming industry. In fact, Tencent’s Honor of Kings has consistently topped the charts in the last decade.

Its success in the local market can be attributed to its deep integration with Chinese cultural themes, accessibility on mobile devices, and social elements that encourage playing as a team.

Source: Honor of Kings Website

Following the global trend set by titles like PUBG and Fortnite, Battle Royale games have also significantly impacted China. It eventually led to local game adaptations and versions catering specifically to Chinese audiences.

Games like Game for Peace (the Chinese version of PUBG Mobile) have been exclusively developed to meet China’s strict regulatory requirements.

● Massive Multiplayer Online Role-playing Games

MMORPGs hold a special place in the Chinese video game industry, with titles like Fantasy Westward Journey by NetEase and World of Warcraft having a long-standing presence in the market.

These games offer rich storytelling, deep character customization, and expansive worlds that resonate well with the audience’s preferences for immersive experiences.

The social elements of MMORPGs play a crucial role in the genre’s popularity, giving players a chance to form communities, guilds, and in-game friendships.

Source: NetEase Games

How To Market Online Games in the Chinese Market

1. Find a local game publisher

Due to legal restrictions, foreign companies face some hurdles when publishing video games in China. Partnering with a local publisher is often the most viable route to navigate these challenges. This approach involves relinquishing a substantial portion of the game’s revenue, but it’s a strategic investment to gain legal market access.

For example, leading global game companies like Nintendo and Riot Games have successfully entered the local market by partnering with Tencent.

Each company has its specialty, catering to different genres and monetization models. When choosing a local partner, it’s crucial to consider the game’s nature and structure. Is it a mobile game or a platform-based application? Here are the top game publishers in China you can choose from:

- Tencent Games

- NetEase Games

- Perfect World Games

- miHoYo

- 37 Interactive Entertainment

- Beijing Kunlun Technology Co. Ltd.

- Elex Technology

2. Game Localization

When entering the Chinese gaming market, it’s important to remember that the local government closely monitors your game’s content. From the app’s gameplay to the digital advertising materials you’ll release, you must ensure that none of these poses risks to national security, historical accuracy, and social stability.

Even globally popular games have had to modify their content to meet China’s stringent standards. For instance, Tencent adjusted Honor of Kings to portray safer behaviors, while other games had to alter settings or remove violent content to gain approval.

● Applying for an ICP License

An ICP license is mandatory for any business that wants to operate a website or offer online services. And, like it or not, this requirement includes video game applications with in-app purchases.

Besides the ICP license, additional steps and approvals are required specifically for the gaming industry. It often involves obtaining approval from the National Press and Publication Administration (NPPA). During the process, you may need to submit the game for content review to ensure it complies with Chinese regulations.

3. Add the game to local app stores or Steam China

Launching mobile games in China is a different ball game compared to other countries. The local market operates with hundreds of Android app stores instead of the usual Google Play and App Store.

However, we suggest focusing your efforts on the top three options: Tencent’s My App, Huawei App Market, and Oppo Software Store. These platforms cover half the industry’s overall market size.

You have the option to set up a developer account on one of these platforms to enter the Chinese gaming industry. The process will require you to submit standard documentation like your developer license, an ICP license, and possibly a Chinese ID, local bank account, and phone number for verification.

For PC games, the landscape is a bit simpler. Historically, Steam served as a backdoor to the Chinese gaming market. However, the official launch of Steam China in 2020 drastically limited the downloadable video game titles locally.

Source: Steam China Homepage

The Epic Games Store remains an alternative, though it operates in a gray area and could be blocked without warning.

A more secure route is through Tencent’s WeGame platform, which doesn’t require a Chinese game publisher. However, you need an ISBN license and integration of the WeGame RAIL SDK for this process.

4. Launch Pre-registration & Promotional Campaigns on Social Media

If you’re looking for a cost-effective way to promote in China’s gaming industry, leveraging local social media platforms is your best bet.

You can post engaging content that invites participation, such as contests, polls, and in-game sneak peeks. These strategies can build a community around your game even before its release.

Planning your game’s debut on social media channels includes deciding your game’s announcement and target release dates. Launching around holidays or festivals can be particularly effective as these are seasons when online consumer rates are at an all-time high in China.

Before you launch a pre-registration campaign on any platform, you must determine the types of promotional content you’ll need. If you’re introducing a new game, chances are some players are already searching for it on social media and search engines.

Your promotional content will likely lead your target audience to your Steam page or local website, so don’t forget to optimize them as well.

Collaborating with key opinion leaders already popular in the local gaming industry can generate public interest in your game. You can tap into their dedicated fanbases through game reviews and live-streaming promotions. These influencers typically host real-time content on video-sharing platforms like Bilibili, Douyin, Huya, and DouYu Live.

Local gamers playing Honor of Kings by Tencent (Source: SCMP)

Tencent knew the influence of live streaming in the Chinese gaming market. So, in a rare business opportunity, the tech giant collaborated with Alibaba to mark Taobao’s entry to the live-streaming market with an event featuring their game, Honor of Kings.

In the same quarter of the live-streaming event launch, the Chinese gaming company reported a 6% increase in domestic sales.

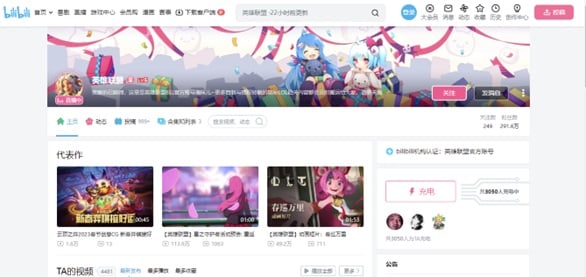

League of Legends Official Bilibili Profile

Major titles in the local gaming industry, like League of Legends (LoL), also managed to create hype within China’s social media landscape by establishing a presence in Bilibili. Today, the game’s official account has over 2.9 million fans.

As you can see above, their social media campaigns range from promotional videos and gaming tips to article columns. Considering the frequency of their posts on this platform, it’s no wonder most of their recent promotional content has thousands of views.

5. Run Paid Advertisements

When advertising your game in China, it’s always wise to go for channels where your target audiences are already settling in. For example, if you intend to release a game through Tencent’s WeGame platform, launching ads within the platform’s ecosystem should be your top priority.

Thanks to its integration with popular apps and services, Tencent’s ecosystem offers a solid audience reach for advertising games. However, you should still diversify your ad spend across other major platforms like Alibaba, Baidu, Douyin, and WeChat to reach more potential consumers.

Typically, these platforms include targeting options to help you reach specific audience profiles, from their age and demographic to other crucial online consumption trends.

Nevertheless, no matter which platform you choose to run ads, remember that the gaming industry in China still answers to stringent digital advertising laws. Failure to obey these regulations may result in penalties or getting banned.

Latest China Gaming Market Trends

1. The Rise of Mobile Games

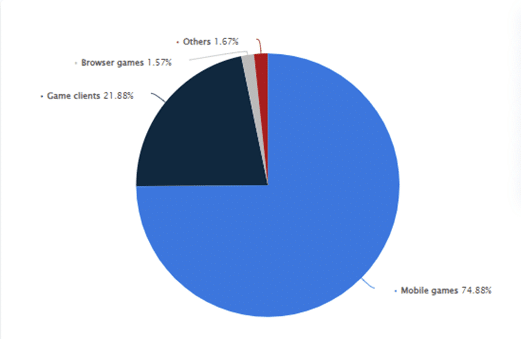

Mobile games are still the largest segment in the Chinese gaming industry. In fact, it covers over 74% of the market’s overall sales revenue. While it continues to scale new heights, it’s a trend that’s hardly surprising given the country’s high smartphone penetration.

The accessibility of mobile gaming has cemented its place at the pinnacle of the gaming ecosystem in China, capturing a vast demographic from casual to hardcore gamers.

Share of sales revenue in the Chinese Gaming Industry (Source: Statista)

2. The Surge of Demand for VR Technologies

With Meta’s strategic partnership with Tencent, 2024 is poised to witness an even more significant surge in VR headset sales within China. While the technology is primarily utilized for social connections and entertainment, it’s gradually making inroads into the Chinese gaming industry.

The Chinese government’s inclusion of VR as a “key industry” in its Five-Year Plan signals a future rich with new technologies and possibilities for gamers and developers alike.

Image by Lifestylememory on Freepik

3. The Return of Remastered Retro Games

Retro games are making a remarkable comeback, remastered with modern graphics and extended storylines to captivate new generations and nostalgic gamers.

This resurgence isn’t just about reliving the past. It’s a strategic move to engage a broader audience, including those who grew up with classic Nintendo games. Through these releases, the gap between old-school fans and contemporary gaming communities in China will ultimately narrow.

Source: Medium

4. The Popularity of Cross-Media Campaigns

Cross-media campaigns are revolutionizing how games are marketed and experienced, extending their reach beyond traditional gaming platforms to encompass cartoons, books, comics, and more. It’s a strategic shift towards creating a more integrated entertainment ecosystem.

Games like Genshin Impact and Wandering Sword exemplify how leveraging themes from anime and Chinese wuxia literature can attract diverse audiences.

Source: Genshin Impact Website

5. Chinese Games Entering the Global Gaming Market

Another notable trend in the market is the globalization efforts of some major Chinese gaming firms. Companies like MiHoYo, known for Genshin Impact and Honkai Star Rail, actively pursue expansion into international markets. This move is seen through the launch of HoYoverse to cater to segments outside China.

Another example of a Chinese gaming company going global is Tencent. The tech giant has made strategic investments in Japan’s FromSoftware Inc. to expand its international footprint.

Similarly, NetEase has acquired Quantic Dream SA, indicating its ambition to be a global key player in the long run.

Source: Honkai Star Rail Website

With all these strategic business partnerships and acquisitions, the overseas sales revenue for local gaming products reached $17.34 billion in 2023, with significant contributions from major global markets.

These expansions not only introduce Chinese gaming products to international audiences but also foster cross-cultural exchange and collaboration within the global gaming ecosystem.

6. Mobile vs. Console Gamers

The split between mobile and console gamers in China is nearly even, with over 65% of adults preferring mobile-based games. This percentage is relatively lower than the USA’s data of 37%.

The prominence of mobile gaming is further underscored by Chinese companies’ significant share of global mobile games revenue, accounting for 47% worldwide.

In China, console gaming remains a relatively smaller segment than mobile games, generating $2.29 billion in 2022. Nevertheless, both segments are experiencing growth, typically driven by technological advancements and changing consumer behaviors.

Successful Brand Partnerships in the Chinese Gaming Market

The continued growth of China’s gaming industry opens a ripe business opportunity for traditional foreign brands. Through brand partnerships with popular games and platforms, marketers can tap into their massive user base and promote their products to China’s younger demographic.

Here are some campaigns that found unprecedented success using this strategy:

- KFC’s Genshin Impact Gift Pack Campaign

The collaboration between KFC and the hit Chinese game Genshin Impact is a shining example of successful brand-game partnerships in 2021. With over 64 million monthly players, KFC managed to tap the game’s ongoing popularity by offering a special meal set that included Genshin Impact-themed gifts.

This strategy not only resulted in a surge of in-store purchases but also ignited a frenzy online, with the campaign reaching over 120 million views on Weibo.

KFC x Genshin Impact Campaign Video (Source: Weibo)

- Hermès WeChat Mini-Games

As mentioned earlier, mobile gaming covers a significant portion of China’s video game market. Hermès managed to take advantage of this trend by launching interactive mini-games on WeChat.

The brand introduced a Space Invader-style game, where players can shoot at letters spelling out “Hermès” and various products. Through this campaign, they managed to connect to the gaming demographic of WeChat without compromising the brand’s original identity.

Hermès Space Invader-style WeChat game (Source: Jing Daily)

- Burberry for Honor of Kings Skins

Burberry has ventured into China’s gaming scene, creating exclusive outfits for one of the country’s most popular video games. These skins allow players to customize their characters with the brand’s iconic designs, including the signature trench coat and tartan pattern.

It marks a strategic move by the global brand to blend luxury fashion with gaming, exclusively for the Chinese market.

This approach keeps Burberry relevant in China’s ever-changing digital landscape and builds bridges to future consumers, ensuring the heritage brand remains a part of their daily lives.

Video Game Character on Honor of Kings Wearing Burberry Skins (Source: BBC)

When to Consider Marketing Your Game in China

In a perfect world, the rapid growth of China’s gaming industry should be enough of an invitation to enter the market. However, the reality is you must consider the local demand for your game to avoid wasted resources.

If over 15% of your game’s wishlists are from China, it suggests significant interest, making it worthwhile to pursue active marketing efforts in the Chinese gaming market. A noticeable increase in sales from the region is also another sign of possible demand.

It’s also worth checking for comments on your Steam page or mentions on Chinese social media platforms to determine if your game resonates with local players.

What are the Challenges of Launching Video Games in China

The Chinese government highly values the welfare of young people. Because of this, they limit gamers aged under 18 to three hours of online gaming per week. To prevent gaming addiction, authorities also demand local game publishers add spending limits on gaming applications and ban log-in rewards.

They impose strict content restrictions on games, mandating that all text, including in-game titles, be in Chinese and forbidding terms that are deemed inappropriate. These censorship rules may affect aspects of gameplay and character narratives from foreign titles.

Obtaining video game licenses can also be challenging, especially if you’re unfamiliar with the process or not up-to-date with the industry’s regulations. They can pause the approval of new games for extended periods, as seen in an eight-month freeze in 2021. This uncertainty can delay game launches and affect developers’ plans.

On the bright side, the industry has experienced swift regulatory shifts, such as the sudden approval of 105 games after a period of restrictions. While such changes can be positive, they also add unpredictability to the market.

Quick Q&A

Do you need an ISBN to release a game in China?

Absolutely! An ISBN (International Standard Book Number) or Game Registration Number (GRN) is mandatory for releasing games on any major platform within China. The sole exceptions are free games that lack in-app purchases. It’s a publishing license regulated by the National Press and Publication Administration.

Ready To Dominate The Gaming Industry in China? Get In Touch With Us Today!

Your digital marketing strategy can make or break your entry into the Chinese gaming market. If you want to succeed, you must be ready to embrace China’s diverse digital landscape, from its unique publishing process to distinct social media and advertising channels.

At Sekkei Digital Group, we can help you boost your game’s visibility and find success amidst tight competition. Through our team’s expertise, we’ll ensure that your brand will obtain strategic positioning in a rapidly changing gaming market in China.

Whether it’s launching an advertising campaign in the local gaming market or finding a KOL to work with, we have all the digital solutions you need. Contact us today, and let us help you navigate the intricacies of China’s business scene.

References:

Gaming Industry in China Size & Share Analysis

Video Game Industry: Statistics, Demographics and Trends in China

China’s Video Games Market: Mobile and client games take the largest share

How to Release a Game in ChinaLongreads China

Top trends in Chinese gaming in 2024