Last Updated on August 30, 2022

Last week, China just completed its mid-year e-commerce shopping festival known as “618”. 618 refers to June 18th, which was the anniversary of JD at first. It then became the second-largest e-commerce shopping festival in China, only behind Singles Day (November 11, aka: Double 11). Possibly, it is the second-largest shopping festival in the world.

The annual “618 Shopping Festival” has become a significant target of business for all e-commerce platforms as the most important consumer battleground in the first half of the year. And, the presale began as early as May. This year’s 618 has improved shoppers’ buying experience, simplified promotion regulations, richer lists, more effective logistics, and more attentive after-sales services supplied by each e-commerce platform, attracting more consumers to participate in the online shopping binge. So, let’s take a look at how each e-commerce platform, category, and brand perform on 618.

Notice:

The data in this report comes from the big data system independently developed by Syntun, which can real-time monitor, collect, process, integrate, calculate and analyze the data from e-commerce platforms. The range covers over 40 platforms, including 2505 categories, 87,238 brands, and 20 million commodities. The data period starts 20:00 May 31st, 2022, ends 24:00 June 18th.

Gross Merchandise Volume

According to the data observed by Syntun, during 2022 China 618 Shopping Festival (from 20:00 on May 31st to 24:00 on June 18th), the GMV of the major e-commerce platforms (only including traditional e-commerce platforms and livestreaming e-commerce platforms) was 695.9 billion RMB.

Top 3 E-commerce Platforms

The top three platforms were no different from previous years, with Tmall still holding the top spot, followed by JD and PDD. Besides, the GMV of traditional e-commerce platforms reached 582.6 billion yuan this year.

Top 3 Live streaming Ecommerce Platforms

With a GMV of 144.5 billion yuan, live streaming ecommerce platforms performed admirably. Due to the departure of Li Jiaqi and other DianTao chief Live Streamers, the ranking of livestreaming ecommerce platforms in 618 was altered, with DianTao falling below TikTok and KuaiShou to third place.

New Retail E-commerce Platforms

In terms of new retail platforms, the GMV reached 22.4 billion yuan during 618 Shopping Festival, with the top 3 new retail platforms sales being JDtohome, Mei Tuan Shan Gou and Tao Xian Da respectively.

Community Group Platforms

Top three platforms are Duo Duo Mai Cai, Mei Tuan You Xiang, Xing Sheng You Xuan. These platforms joined the 618 competition this year. The GMV reached 15.3 billion yuan in total.

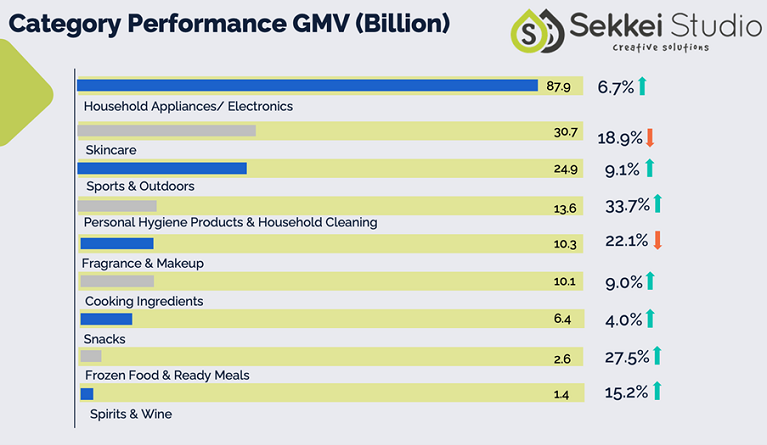

Sales Categories

In terms of sales categories, household appliances and electronics, which took first place, performed well and increased with a growth rate of 6.7 percent year on year. While skincare and fragrance & makeup decreased 18.9% and 22.1% year-on-year.

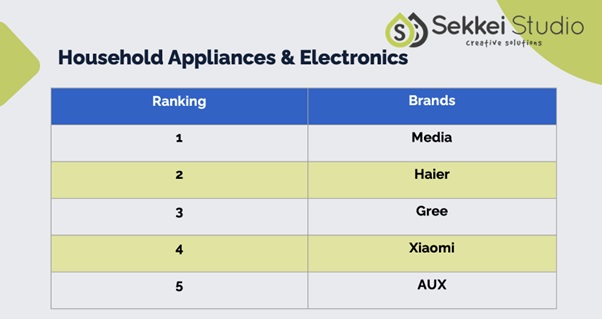

GMV of Household Appliances/ Electronics during 618 reached 87.9 billion. Midea, Haier, and Gree performed as the top three popular brands.

GMV of Sports & Outdoors during 618 reached 24.9 billion. Top brands are as follows.

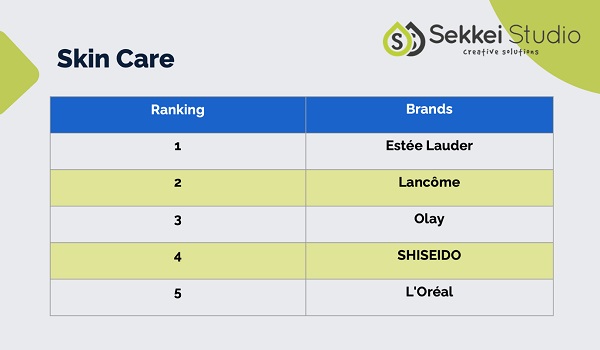

GMV of Skincare during 618 reached 30.7 billion. Estée Lauder, Lancôme, and Olay performed well.

GMV of Personal Hygiene Products & Household Cleaning during 618 reached 13.6 billion. Vinda, BlueMoon, and Kérastase performed well.

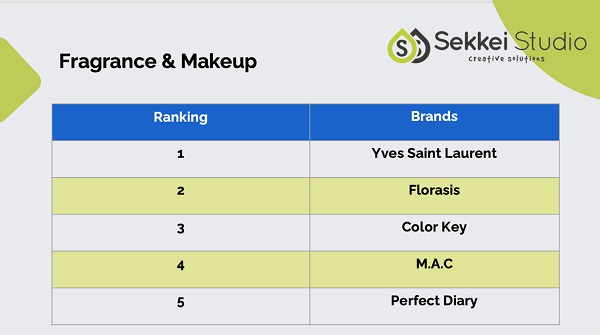

GMV of Fragrance & Makeup during 618 reached 10.3 billion. Yves Saint Laurent, Florasis, and Color Key occupied the top three places.

GMV of Cooking Ingredients during 618 reached 10.1 billion. Top brands are as follows.

GMV of Snacks during 618 reached 6.4 billion. Three Squirrels, BESTORE, and Be & Cheery are the top three brands in this category.

GMV of Frozen Food & Ready Meals during 618 reached 2.6 billion. Here are the most popular brands.

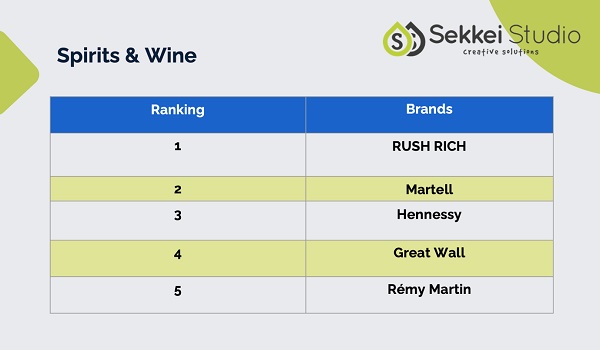

GMV of Spirits & Wine during 618 reached 1.4 billion. The top brands are as follows.

Chinese eCommerce festivals are one of the major calendar related event where brands can achieve half of the annual GMV in a couple of hours. The preparation for these promotional days does not start the day before, it’s the concerted effort your China eCommerce team puts together in order to: build a quality e-store, gather a community around the brand, drive quality traffic and increase the s-store’s visibility. At Sekkei Digital Group, we have more than 13 years of experience in the Chinese digital marketing ecosystem and have always gave our clients the right visibility and approach to their eCommerce projects in China. Let us know more about Your eCommerce project