Last Updated on May 15, 2024

From a recent report released by the Chinese company YouWant (specialized in live commerce and Chinese social media data), Sekkei Digital Group has summed up 12 main insights on Live Commerce in 2022 China. Factors like products type, price, shoppers age, gender, Chinese calendar events and eCommerce features are influencing the Chinese Live Commerce trends in a unique way. Below is a summarized version of this insightful report:

Insight 1: Food, beauty and fashion still reign supreme

While live commerce may have diversified a lot over the last year, there are certain topics that still dominate the industry. Perhaps unsurprisingly, the way people look, and the things that they eat, remain the most salient topics when it comes to the (mostly) user-generated video sales format. The report details the five top categories of consumer interest: clothing (both men’s and women’s combined) is the subject of videos watched by 29.44% of total viewers, food and beverage comes in close second at 28.64%, skin care comes a distant, but still significant, third, at 14.05%. Shopping for daily necessities comes fourth at 7.66% and shoes and bags come in fifth at 6.13%. All other topics collectively only garner the remaining 14.08% of viewership.

Food & Beauty WeChat stores. Source: daxueconsulting.com

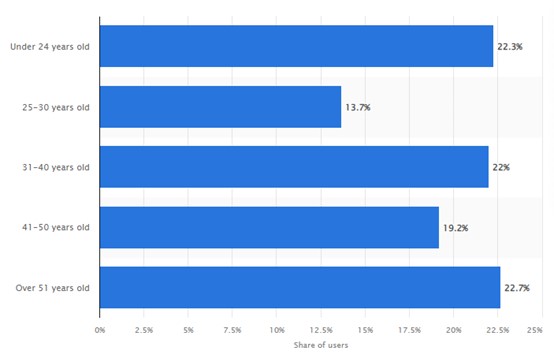

Insight 2: Move over millennials, here come the… Gen X?

Common sense might dictate that new technologies age out older generations, and therefore live commerce marketing should be directed towards and for young people; specifically for Gen Z, the first true generation of digital natives. Enter, what the report calls, the ‘silver-haired group’. Shattering expectations, audiences of older generations are growing significantly, as they embrace technology to share stories of their lives, to communicate with one another, to stay up to date with fashion, and to cash in on the latest bargains. It should be noted that this effect is especially noticeable when it comes to WeChat channels.

Distribution of WeChat users in China as of March 2022, by age. Source: statista.com

Insight 3: Half the market is supported by female consumers

This may sound like a no-brainer, but the report details that women make up half the market. This insight appears to be more metaphorical than data-driven, however, and there are a couple of important points that it highlights. First, it mentions how women are trending more towards buying items that are associated with elegance, intelligence, and cultural depth. Second, there’s a new-ish shopping festival that is specifically angled towards women – from now on, 8th March, which is officially international women’s day, will be celebrated by e-commerce giants in China as ‘goddess festival’.

Insight 4: Cheap tat is fading – consumers increasingly go for high unit price items

While traditionally live commerce has been modelled towards shipping large quantities of low-price goods, in recent years there’s been an upswell in high unit price sales. The report details how WeChat channels and their associated tools allow sellers to form much more personal relationships, and build trust, with consumers. The extra trust pays off, with items like gold jewellery and digital home appliances more frequently purchased than before. Social CRM can prove to be of vital use here.

Insight 5: Cheap goods aren’t out the window yet, as long as they’re decent

While high unit price purchases are on the rise, it’s still the case that low unit price items dominate the market. The report mentions that goods under 100RMB – usually practical items – account for 71% of all sales in live commerce. The report attributes this to a ‘restraint of rational consumption’ among Chinese netizens.

Source: YouWant

Insight 6: Consumption changes with the seasons

Like insight 3, this could be considered a no-brainer. In fact, it is a no-brainer. People like to buy clothes that match the weather they can expect from the coming season. One point that’s highlighted in the report is that spring and summer tend to show more activity in this regard, but it offers no analysis as to why. Perhaps after a long winter, consumers are looking to reinvent themselves, but really, there’s no data here, and we strive to make our advice data-driven, so let’s move on to the next insight.

Insight 7: Snacks! Snacks! Everybody loves snacks!

As mentioned in insight 1, food and beverage play a huge part in the symphony that is China’s live commerce market. Snacks such as nuts are very popular, as is traditional Chinese bread (shāobǐng), and fresh, seasonal fruit. Rice isn’t a snack, at least to most people, but particular brands find a lot of success, especially among consumers who have moved around the country and miss the rice of their region.

Insight 8: Skincare for all

Skincare is an evergreen, when it comes to live commerce in China. We’re talking SPFs, moisturizers, cleansers and, in a big way, facial masks. The most interesting point in the report on this topic is that skincare is growing in popularity among male users. The report notes a giant leap in demand for these products in March, but does not proffer any possible causes of this leap.

Month by month growth in skincare sales. Source: YouWant

Insight 9: Dressing to impress

As quality of life and disposable incomes increase across China, more and more consumers are spending money on cosmetics. The top-ranking product in terms of consumer preference is lipstick, which commands a 19.5% share, while liquid foundation is second at 16.8%, perfume third at 14.2%, and pre-makeup moisturizer cream and eyebrow pencils tied at 7%. Once again, the report highlights a leap in demand for these products in March, without suggesting reasons as to why the leap occurred, nor providing data for following months.

Insight 10: Chinese regional food products are hot property

This is a genuinely interesting development, and one worth taking note of. In the past, international food products that were fawned over and sold at higher prices. Now, however, we see the rise of domestic, regional products being highlighted. Examples include tangerines from Sichuan, raw cane sugar from Yunnan, steamed buns from Shandong, rice noodles from Jiangxi, and dried mulberries from Xinjiang. Live streamers highlight the authenticity, the cultural and agricultural importance, of these products.

Insight 11: Sales relevant to current issues

In this insight, the report highlights sales that are ‘out of the circle’, an idiom which is usually applied to people or issues that have recently grown in prominence, in the minds of the public. That is to say, issues or people that no longer only hold sway in their own circle. As such, the report highlights that walnuts from Xinjiang, and bread from Russia, are selling particularly well.

Popular food products. Source: YouWant

Insight 12: The launch of the shopping cart

WeChat channels has introduced a shopping cart feature to its live streams. By creating less friction between exposure and purchasing, shortening the customer journey, it is hoped that sales will increase. There is also a one-click purchase option, making the journey even shorter.

We have been helping companies to setup and run their eStores in China’s main eCommerce platforms. A Big part, not to say the most vital one, in eCommerce operations is sales support and promotion. From Ads to Live Streaming and KOL/KOC collaborations, Sekkei Digital Group has been increasing both its portfolio of eCommerce clients and its expertise on the matter. Let us know more about your eCommerce project in China, our consultants can help you understand how to plan the right approach to take your GMV to the next level.