Chinese consumers have always been enthusiastic about buying health products or any brand related to wellness. This strong preference stems from a cultural standpoint, where traditional Chinese medicine is believed to be an effective medical system to prevent illnesses.

Nowadays, health and nutritional supplements are gaining positive market insights in China. With an estimated value of around $4.82 billion in 2023, it’s no wonder more and more health supplement brands are entering the industry.

In this post, we’ll discuss key trends in the health supplement market in China and effective strategies international brands can implement to attract local consumers.

Does China Regulate Supplements?

Yes, China regulates all supplements circulating within the local market. Foreign and domestic brands must abide by the regulations set by the State Administration for Market Regulation (SAMR) and the National Health Commission (NHC).

On top of that, all products categorized by health must undergo testing and approval processes conducted by the State Food & Drug Administration.

Functional health supplements and nutrition-based products (vitamins, fish oil, etc.) will have different approval processes. The latter usually have a shorter filing duration, but it all depends on the product’s country of origin.

Key Figures of China Supplement Industry

Before selling supplements and other health foods locally, you must know what kind of market you’re trying to enter. Here are some key figures foreign brands can leverage for a successful digital marketing strategy:

- The COVID-19 outbreak increased the consumption of dietary supplements in China

- 30% of the Chinese population will be turning 60 years old by 2050

- Traditional beauty standards are the primary revenue drivers of skin health supplements

- Young people in China under 30 years old show high interest in buying vitamins and health supplements

Top Consumer Trends in China’s Health Supplement Market

● The Rise of Dietary Supplements in China

It’s no surprise that female consumers mainly drive China’s high demand for weight management products. However, the previous pandemic has obviously heightened consumer awareness among local consumers, resulting in more interest from different age groups.

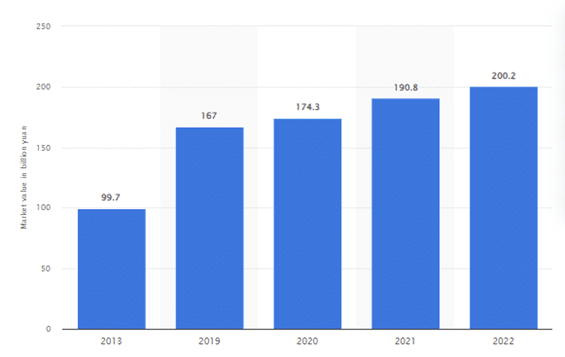

In 2022, the Chinese dietary supplement industry has an estimated market share of 200.2 billion yuan. If you compare it with the 2013 data, it’s easy to see that this local business segment has grown twofold.

Size of dietary supplements industry in China 2013-2022 (Source: Statista)

Taking supplements that assist with weight loss is generally seen as immunity boosting. Its health benefits often come from minerals like Calcium and Vitamin D, which help people meet their daily nutrient requirements.

In a survey by Rakuten Insight, most people who said they often take dietary health supplements are younger consumers aged 25-35. This trend also seems more prevalent within middle-aged groups, with 51% of the respondents under the category confirming their consumption of diet supplements.

● COVID-19 After Effects & Older Chinese Consumers

During the COVID-19 era until today, there was a heightened focus on preventive healthcare, leading to more informed and health-conscious consumer behavior. Chinese residents are now more willing to invest in quality health supplements.

Although the previous pandemic has interrupted the supply chain of imported supplements, the rise of online sales channels has helped many overseas brands reach more Chinese consumers.

The notable shift toward virtual shopping eventually led to the increased revenue of nutrition-based products within Chinese e-commerce platforms. The market adapted quickly with localized supply chains and diversified sourcing.

Photo by Polina Tankilevitch from Pexels

The number of Chinese consumers over the age of 60 has grown significantly over the past year, with a population size of approximately 280.04 million. This aging population translates to a higher demand for supplements catering to health concerns related to the immune system or cardiovascular system.

Unlike young people, older local consumers show more preference and trust for health supplements infused with traditional Chinese medicines. Because of this, you’ll notice that most best-selling brand offerings on different sales channels follow this trend religiously.

● The Increasing Preference for Portable Health Food

As modern lifestyles become more fast-paced, young Chinese consumers who seek nutritional benefits are turning to convenient health foods. Typically, these products come with small, portable packets to make their daily use easier to consume during a busy day.

Young consumers see these health supplements as an excellent alternative to reduce stress, improve sleep quality, boost immune support, and enhance overall health without the hassle of lengthy preparations.

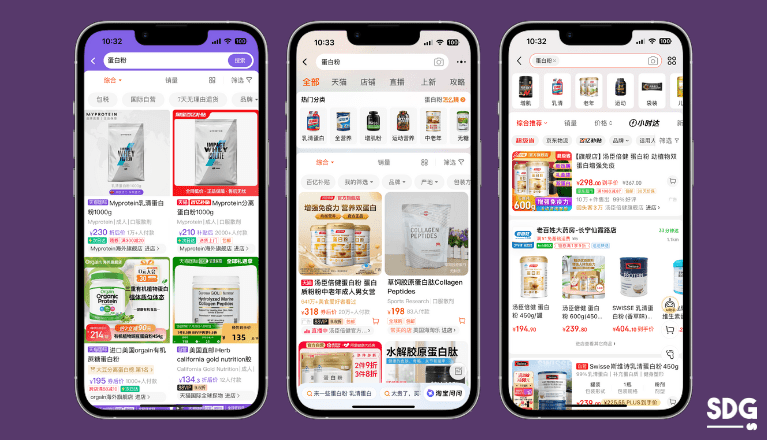

Example of protein powders on Tmall Global, Taobao and JD.COM

On JD.com, there’s been a notable increase in sales of on-the-go nutrition products. Portable protein powders and spoon-fed honey packs saw sales jumps of 68% and 1,095% YoY.

Over the past year, industry experts also saw a growing trend in immunity-boosting mini tablets and oral liquids, doubling sales as they offer excellent portability.

● Mineral Supplements for Maternal & Baby Health Food

China’s implementation of the three-child policy in 2021 has generated an increase in demand for health food products aimed at mothers and babies. According to iResearch Study, the industry’s market value reached around 81.9 billion RMB within the following year the policy was announced, and many expect it to continue.

Between 2020 and 2022, mineral supplements were the most popular category in online sales of maternal and baby health foods, making up over 40% of the total sales in this segment. Notably, calcium supplements alone accounted for 46.3% of these sales.

● High Demand for Health Products from Foreign Brands

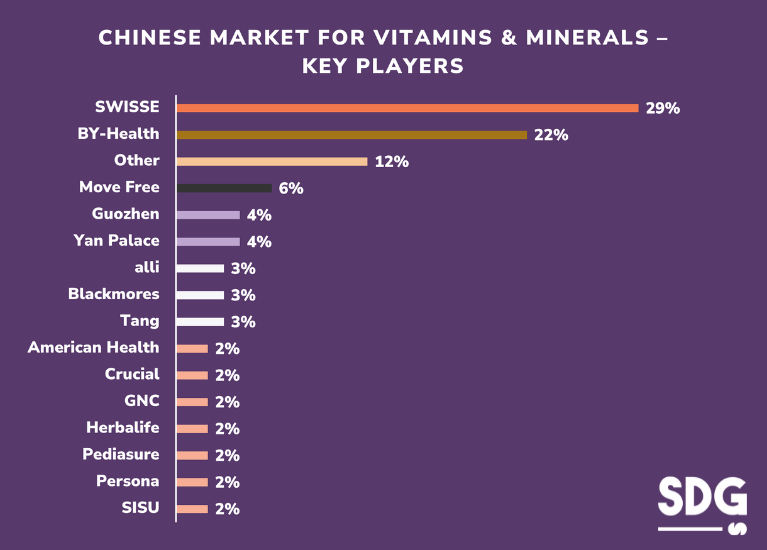

You may not know, but the best-selling health supplement in China nowadays is the Australian brand, Swisse. It currently covers 29% of the overall market for vitamins and mineral-based nutritional supplements.

Seeing such information in recent statistical reports, it’s clear that the demand for foreign health foods and supplements will maintain its upward momentum for years to come. And since younger consumers are the ones driving growth in the industry, foreign brands must find a way to continue catering to their changing needs when it comes to wellness.

Chinese Market for Vitamins & Minerals – Key Players (Source: Statista)

It’s also important to note that local health supplements like BY-Health are highly regarded by Chinese consumers, with over 22% significant market share in the industry. Foreign marketers can observe what their domestic competitors are doing to gain valuable insights into consumer behavior and market trends.

How to Promote Health Supplement Brands within the Chinese Market

Promoting health supplements in China requires a multifaceted strategy. Marketers must understand China’s unique consumer behaviors, preferences, and digital landscape. Without these factors, it’ll be challenging for their promotional campaigns to be effective.

1. Follow the Market Regulation

The Chinese government has stringent regulations when it comes to health supplements circulating in the local market. If you’re considering advertising your products in China, you must abide by relevant laws and terms to avoid legal issues or penalties.

Besides the advertising laws, brands must disclose the product function and ingredients of their supplements. If you have the intention of physical and direct selling, be sure also to follow the importing regulations and standards set by the government.

All the legal aspects of selling and importing nutritional supplements can change abruptly. So, it’s always wise to stay updated on the latest industry news to help your brand maintain market presence and credibility. If it becomes overwhelming, working with a reliable digital marketing agency is always a wise investment to consider.

2. Localize Your Brand for Chinese Consumers

Consumers within the Chinese market are different from your typical online shoppers. Regardless if you’re marketing fish oil or vitamin products, these local customers will find a way to know more about your business. Because of this, it’s crucial to localize your brand to generate credibility and authenticity.

You may think translating all your website and marketing content is the only way to do this. However, your attempt won’t be successful without trying to meet the cultural, aesthetic, and functional preferences of Chinese consumers.

Brand localization efforts could also include modifying product formulations to suit local tastes, using culturally relevant branding and messaging (e.g., launching a campaign during a local shopping festival), and understanding Chinese health and wellness trends.

3. Sell Health Products on Local E-Commerce Platforms

Listing your health supplements on local e-commerce platforms is an excellent way to leverage China’s 850 million online shoppers. With around 40% of the country’s GDP coming from this channel, there’s no doubt it can help businesses generate revenue with the right marketing strategy.

● Tmall Global

This social commerce platform is growing rapidly in today’s market, with over 500 million monthly users. It’s an ideal sales channel for international brands looking to enter the Chinese market without establishing a physical presence locally.

It offers a convenient business gateway for international brands. As of 2021, Tmall held over 50% of the e-commerce market value in China.

SDG’s work with Elevant: Tmall flagship store revamp

You can utilize Tmall’s analytics tools to understand consumer trends and tailor your product offerings. On top of that, brands can gain more traction by participating in Tmall’s major shopping festivals for greater visibility.

● JD.com

Another e-commerce channel where you can find potential consumers is JD.com. It’s renowned for its logistics network, allowing the app to gain 569.7 million active patrons per year.

Chinese consumers also view JD.com positively when it comes to reliability and quality assurance. Thanks to this, it has become a preferred platform for consumers focused on authentic and high-quality health products.

● WeChat Store

As you may already know, WeChat integrates social media and e-commerce. Because of this, brands have the unique opportunity to engage consumers directly and personalize their shopping experiences without leading them off the app.

Furthermore, WeChat has over 1.3 billion monthly active users. So, admit it or not, its market reach is beyond any other local platform can offer.

Major global brands already utilize WeChat’s mini-programs for direct marketing and sales. Its built-in payment system also adds to the convenience of not only the businesses but also your potential customers.

By using its combined social and e-commerce features, foreign marketers can build a dedicated community around their brands.

4. Utilize Baidu SEO Strategies

Since Google is inaccessible in China, your SEO efforts should be redirected to Chinese search engines like Baidu. This particular platform boasts around 663 million monthly active users and over 6 billion daily queries.

When optimizing content for your health supplements, remember that Baidu’s algorithms differ significantly from those of Western alternatives. You must also have a website domain name hosted on local servers to rank well on this search engine.

SDG’s work with Sugiyama Maternity Hospital

Baidu SEO strategies include meticulous keyword research to identify the most relevant and popular terms among local users. It’s essential to develop content that incorporates these keywords and is crafted in fluent Chinese, respecting linguistic nuances and cultural context.

Foreign marketers should learn to adapt to Baidu’s SERP features, such as prioritizing mobile optimization and local search elements. By doing so, it can significantly enhance your brand’s visibility.

Don’t forget that Baidu places a high emphasis on the quality and relevancy of content, so ensuring that your website and its contents align with these criteria is vital for effective SEO performance.

5. Promote Your Brand through Social Media

Did you know that 72% of China’s population uses social media daily? With this much market reach, it’s not an overstatement to say that promoting in these channels is essential for your brand’s digital marketing success.

You can start by creating business profiles on popular platforms like Weibo, Douyin (the Chinese version of TikTok), and WeChat. These apps offer a diverse and expansive audience, making them ideal for boosting brand visibility.

We recommend creating highly informative content to resonate with the health-conscious mindset of Chinese consumers. It could include educational posts, interactive videos, and user testimonials highlighting your products’ benefits and efficacy.

SDG’s work with Elevant: KOL and KOC Management

The continuous growth of the dietary supplement market from the pre-COVID period until now can be partly attributed to the rise of health and fitness KOLs.

These influencers often have a significant following and can lend credibility and appeal to your brand through authentic endorsements. KOL marketing strategies also involve participating in viral challenges on Douyin, interactive Q&A sessions on Weibo, or community-building activities on WeChat.

Quick Q&A

How big is the vitamin market in China?

In 2021, the China vitamin market has an impressive value of $15.88 billion. Considering the industry’s rapid growth, it’s expected to reach $45.08 billion by the end of 2023. Factors such as the aging population, rising middle-class affluence, and a growing focus on preventative health care are the main drivers of this expansion.

Why are Health Supplements Popular in China?

The popularity of health supplements in China can be attributed to several reasons. Firstly, the COVID-19 pandemic has heightened awareness about health and immunity, driving many towards supplements for extra protection. China’s aging population has also increased demand for products addressing age-related health concerns.

The economic growth and rising disposable incomes have enabled more individuals to invest in health and wellness products. Lifestyle changes due to urbanization and a faster-paced life have also increased the need for convenient health solutions, such as vitamins and diet supplements.

What are the most popular supplements in China?

The China market has a need for various products that cater to different health needs. Vitamin C, Vitamin D, and multivitamins are widely consumed for general health maintenance.

Today’s market has also seen an increasing preference for dietary supplements like omega-3 fatty acids, fiber supplements, and protein powders from younger age groups in the country. Besides that, supplements incorporating elements of Traditional Chinese Medicine are prevalent due to their cultural resonance.

Ready To Dominate The Health Supplement Market in China? Get In Touch With Us Today!

It’s no secret that marketing in China’s digital landscape entails abiding by local regulations and laws, but even more so for health-related products like supplements and vitamins. The market also includes ever-changing trends that only marketers with local expertise can predict and handle.

Don’t let the complexities of the Chinese market hold you back! Our experienced team is here to guide you through every twist and turn, unlocking your brand’s full potential and ensuring resounding success in China’s dynamic business landscape.

We can help you utilize the power of modern digital marketing, from crafting compelling ad campaigns to harnessing the power of search engine platforms and social media channels. Contact us today to learn more about China’s health supplement market!

References:

Health supplements and vitamins in China: a promising market dominated by foreign brands

Vitamins & Minerals – China

KEY TRENDS SHAPING THE HEALTH SUPPLEMENT MARKET IN CHINA IN 2023

Overseas health supplement market in China in 2022-2023: Tmall sales analysis

PRACTICAL GUIDE TO CHINA’S NUTRITION AND SUPPLEMENTS MARKET