In 2023, approximately $25 billion worth of medical equipment exports came to China from global markets like the United States, Germany, and Japan. And within the same year, the local pharmaceutical market imported foreign medicines valued at over $35 billion.

This surging demand for imported medical devices and pharmaceutical products is primarily driven by the country’s extensive network of hospitals and increasingly health-conscious population embracing wellness trends.

With more global companies entering this segment, the local government’s market regulation is also becoming more stringent. Let us guide you through the steps on how to advertise medical products in China to avoid potential penalties and operational consequences.

The Complex Landscape of Medical Advertising in China

For manufacturers and pharmaceutical companies eyeing the lucrative Chinese market, it’s essential to recognize that the country’s internet advertising law is not a one-size-fits-all regulation. It varies significantly based on product categories, particularly in the medical-related sector.

The laws governing these advertisements address various aspects, from the content and ad format to the platforms on which they can be displayed. Here are specific regulations you must watch out for between these two medical product categories.

Pharmaceutical Advertising Regulations in China

Under the PRC Drug Administration Law, all pharmaceutical advertisements must undergo a pre-approval process by a provincial-level government. They should align based on the local standards set by the National Medical Products Administration (NMPA).

The law also prohibits the inclusion of false or misleading content in drug advertisements, specifically regarding the product’s efficacy or safety. All promotions in mass media must not contain comparisons with other products, promises of recovery after medical treatment, or paid endorsements from pharmaceutical professionals.

Global Pharma, Sanofi, in China International Import Expo (Source: China Daily)

When advertising pharmaceuticals, international companies should remember that prescription and non-prescription drugs are not under the same regulations. Medical institutions trying to promote prescription drugs may need to follow stricter guidelines and are often restricted in medical journals.

Meanwhile, unlike prescription-only medicines, advertisements for over-the-counter drugs are less regulated. However, these products should still display the over-the-counter (OTC) mark and appropriate usage instructions.

Image by wirestock on Freepik

China’s stringent advertising law dictates that all promo content under this category must indicate the product’s possible risks, minor toxic side effects, and adverse reactions. Pharma companies should also include the drug advertisement approval number on their promotional campaigns.

With the new law and administrative regulations, drug advertisements are expected to be on continuous display. This rule comes after the revision of the previous guideline, where the government required a minimum of five-second ad intervals.

● Pharma Products You Can’t Advertise in China

For a foreign pharmaceutical business trying to export to China, it’s crucial to understand the unique nuances of advertising pharmaceuticals to the public.

The country’s drug regulatory department, particularly the Administrative Measures for Review of Drug Advertisements, sets clear boundaries on what can and cannot be promoted openly.

These prohibitions include the advertisement ban for narcotic drugs and pharmaceutical precursor chemicals.

Toxic drugs for medical use and psychotropic drugs are also under the pharmaceutical categories banned in any advertising format. On top of that, healthcare institutions are not allowed to promote their pharmaceutical preparations to the public.

Last but not least, the regulations also forbid drugs specially needed by the military to be in promotions that constitute advertising formats.

Medical Device Advertising Regulations in China

Medical device advertisements follow specific guidelines from the Regulation for Supervision and Administration of Medical Devices (RSAMD). Like non-prescription drugs, promotions for this product category will always require the inclusion of ad approval numbers regardless of the chosen format.

The medical advertising content should also undergo a rigorous review conducted by the local NMPA. Any changes made to the promotional campaign after the approval of the ad content will require another application from its publishers.

Image by DC Studio on Freepik

When launching medical device advertisements for the public, the equipment’s potential contraindications and limitations should be indicated clearly in the content.

Promotions for medical devices must be truthful. It should not, in any way, exaggerate the device’s capabilities. It must have a clear precautionary notice informing the user to read the equipment manual or follow the directions given by healthcare professionals.

Besides that, the company names of medical device manufacturers and the product’s registration number should be stated in every ad placement.

Medical device exhibit at China International Import Expo in Shanghai (Source: China Daily)

Medical devices come in different categories, so it’s only natural that they may be subject to varied advertising guidelines. A piece of equipment under a more critical or invasive category often faces extensive restrictions. These rules ensure the advertisements do not mislead regarding the device’s use and safety.

For example, if the medical devices you’re trying to promote are meant for internal use of an institution, they’re prohibited from having any form of advertisement content, offline or online.

Health Food Advertisements in China

Another sensitive touchpoint in China’s digital advertising landscape is handling promotions for health foods. These promotional campaigns fall under the jurisdiction of the State Administration for Market Regulation (SAMR) and the National Medical Products Administration (NMPA).

Like medical devices and pharmaceutical goods, health food and supplement advertisements typically require pre-approval. It involves a thorough review to ensure that the promotions don’t have unproven health-related claims or suggest that they can replace medical treatments.

Photo by Polina Tankilevitch from Pexels

The local government strongly advises against exaggerated claims about the product’s effectiveness or safety. This regulation aims to prevent consumers from being misled into using supplements as substitutes for necessary medical treatments.

If the product has a health benefit claim, it should be backed by scientific evidence and expert recommendations of medical representatives.

For these promotional campaigns, audience targeting must be conducted delicately. Advertisers must not target vulnerable groups like minors or make claims that exploit consumers’ lack of knowledge in health and nutrition.

General Digital Advertising Law Considerations

If you intend to launch drug or medical device advertisements on e-commerce and social media channels, your promotional content must not contain deceptive statements to induce sales. Terms like “safe,” “non-toxic,” or “natural” are some of the exaggerated marketing words that can result in censorship or account deactivation.

Unlike typical product categories, medical-related goods cannot launch campaigns like free treatment, sale, or trial.

SDG’s work with ELEVANT®: Censored Keywords Moderation

Different online platforms may have additional internal policies governing medical product advertisements. Advertisers must comply with these as well as national laws.

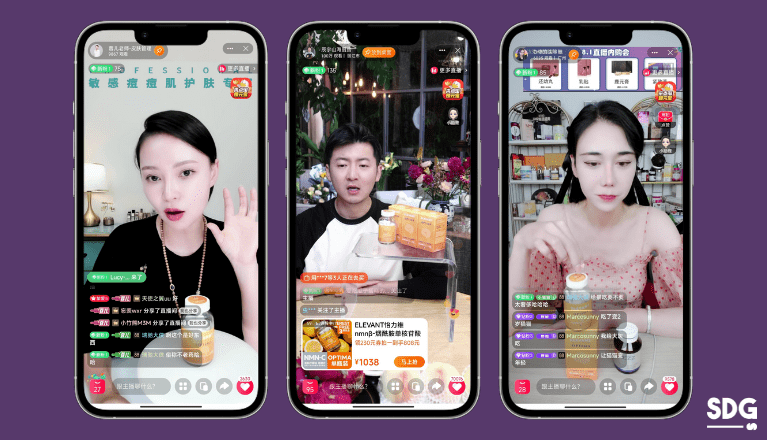

While live commerce and social media are popular advertising channels in China, remember that these platforms are heavily regulated. Each may have different approval procedures, ensuring your promotional content won’t mislead or provide incorrect medical information.

Obtaining Digital Advertising Approval in the Chinese Market

Similar to traditional media, digital advertisements for medical devices and pharmaceuticals also require pre-approval. However, the process may involve additional requirements due to the broad reach and immediate impact of digital platforms.

The approval authorities, typically the NMPA and SAMR, will review the digital advertisements to ensure compliance with general advertising laws and specific regulations on medical products.

Once approved, the ad can be used nationally, with the approval number valid for two years. However, the approval can be revoked or require reapplication if there are significant changes to the product or its use.

Best Practices for Advertising Medical Products in China

● Be extra careful with KOL Collaborations

Drug and medical device advertisements navigate more stringent regulations than regular product categories in China. It’s important to note that the experts in this industry, such as healthcare professionals, are not allowed to do paid endorsements.

While collaborating with top health and wellness KOLs can enhance your audience reach, they still must comply with specific regulatory requirements set by Chinese health authorities.

Regardless of format, any promotion done by KOLs must adhere to the approved information about the products and avoid making unverified health claims. Failure to abide by the regulations may incur penalties for the brand, and the influencers in question risk suspension from product promotion activities for a specified period.

SDG’s work with ELEVANT®: KOLs Collaboration

● Develop a solid B2B Marketing Strategy

When advertising medical products in China, it’s crucial to approach platform selection to understand where business clients and professional audiences engage. Your local B2B strategy should prioritize establishing consumer relationships and building brand credibility.

This approach includes leveraging social commerce and cross-border platforms like Alibaba and Pinduoduo. Having a presence on these channels can help you connect with potential business clients, distributors, and industry partners in your niche.

Foreign brands can also utilize these digital channels to showcase expertise, share detailed product information, and engage in meaningful business-to-business transactions.

The overall goal is to align your digital presence with the needs and expectations of the intended audience within China’s medical goods market.

● Improve Your Brand’s Local Reputation

Chinese consumers often seek detailed information before purchasing health-related goods. Therefore, your advertising strategy should focus on educating the consumer about your product’s benefits, usage, and any scientific backing.

This approach not only builds trust but also aligns with the anti-unfair competition law implemented by the Chinese government.

Quick Q&A

How big is the medical device market in China?

China is one of the leading countries in the medical device trading industry. In 2023, its approximate value reached around $44.8 billion. It accounts for 8% of the total global market value.

How big is the pharmaceutical industry in China?

China’s pharma industry generated an impressive operational revenue of around 3.36 trillion yuan in 2022. This growth mainly comes from the country’s aging population, increasing healthcare expenditure, and government initiatives. The growing middle class also have a higher demand for quality medical services and products.

What is the pharma industry outlook in China?

Several industry indicators show that China’s pharma market will grow by 7.22% between 2024 and 2028. Furthermore, multinational pharmaceutical companies are reworking their business models in the country. It involves local partnerships and strategic collaborations to commercialize products in the local market effectively.

Who regulates medical-related advertisements in China?

The State Administration for Market Regulation (SAMR) is the main governing body that oversees all advertisements related to drugs, medical devices, health food, and any consumable products for special medical purposes.

Your Trusted Digital Advertising Market in China!

The complexity of pharmaceutical and medical device advertising often stems from China’s stringent laws and regulations to protect the interest of regular local consumers. Brands trying to enter this industry must learn to adapt and innovate to stay competitive and compliant.

At Sekkei Digital Group, we can help you find a balance between your brand’s advertising goals and regulatory compliance. Through our team’s expertise, we can help find your strategic positioning in a rapidly changing landscape.

Whether it’s crafting compelling advertising campaigns, utilizing social platforms, or collaborating with relevant KOLs, we have all the digital solutions you need. Contact us today, and let us help you navigate the intricacies of China’s business scene.

References:

Pharmaceutical Advertising [Chambers]

Regulation of drug and medical device advertising in China: an industry under the microscope

How to effectively advertise pharmaceutical and medical devices in China?

How to Advertise Your Medical Device in China?