Since the rise of social commerce platforms in China, Chinese consumers have been quite taken by livestream shopping trends. In fact, this continuous popularity has led the live commerce market to garner high total retail sales and gross merchandise value of 3.5 trillion yuan in 2022.

Unlike Western consumers, live shopping has become an integral part of the consumption cycle of Chinese shoppers. Naturally, brands and retailers from Western markets have noticed this growth and are now looking into ways to sell products to this new target audience.

In this post, we’ll explore the influence of live commerce in China and explore different platforms that will help foreign brands attract customers in the Chinese market.

Why is live shopping popular in China?

According to CGTN, around 99.6% of Chinese internet users browse the web through their phones. With high smartphone penetration rates and a preference for mobile transactions, live shopping caters perfectly to this consumer behavior.

On top of that, the deep integration of commerce and social media platforms in China creates a seamless transition for users to switch from watching a live stream to making a purchase.

Image by our-team on Freepik

Major platforms are continuously enhancing the e-commerce experience within their interface for customers and businesses alike. Today, live streams stand as not only a form of entertainment but also as sales channels that can bring potential revenue to brands.

The fandom culture of Chinese consumers toward live streamers or influencers also contributes to the rapid growth of livestream commerce. These Key Opinion Leaders (KOLs) have built trust and connection with their audience, making their product endorsements highly effective for generating sales and interest in new brands and retailers.

How does live shopping in China work?

Live shopping in China operates through a sophisticated blend of technology, social media influence, and e-commerce. It begins with platforms like Taobao Live, Douyin, and Kuaishou, which provide the technological infrastructure for live streams.

These platforms are intricately linked with e-commerce systems, allowing instant purchases during live sessions. Key Opinion Leaders (KOLs) or influencers with substantial followings on these platforms often host these live shopping events.

Interaction is the key element marketers must consider when using livestream commerce as part of their promotions. Regardless of which channel or platform you use, viewers must be able to ask questions, give immediate feedback, and even influence the course of the live event.

As products are showcased, some platforms allow consumers to make a purchase with just a few clicks without needing to leave the ongoing live streams or jump from one platform to another.

This ease of transaction is crucial in capturing the impulse buying behavior that is common in online shopping. Behind the scenes, companies must extensively prepare for these sessions, often involving careful product selection and strategic marketing campaigns to attract potential customers and sell effectively.

Top 9 Live Shopping Market Trends in China

1. The Exponential Growth of Livestream Commerce Market

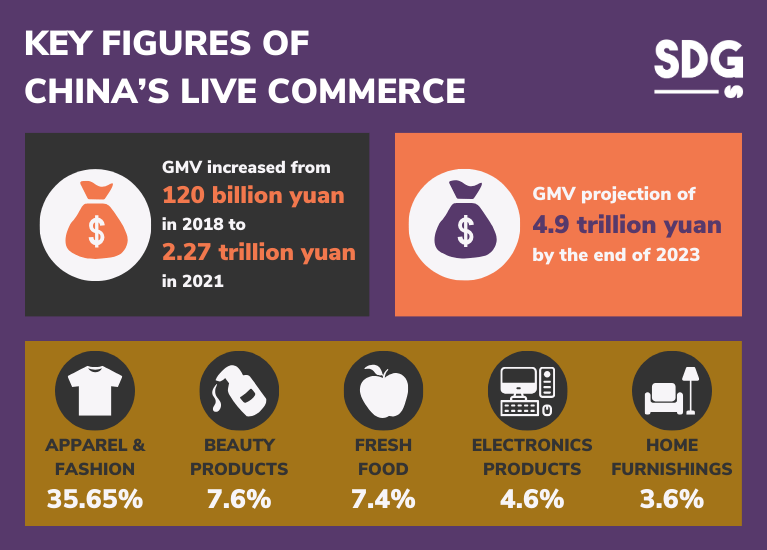

Through the continued love of Chinese consumers for livestream shopping, the gross merchandise value of eCommerce live streaming in China experienced a massive increase from less than 120 billion yuan in 2018 to 2.27 trillion yuan in 2021.

Looking at these numbers, the e-commerce live streaming in China has skyrocketed by more than 18 times higher. And according to recent reports, its rapid expansions show no sign of slowing down, with a projected value of 4.9 trillion yuan by the end of 2023.

2. Live Commerce Now Caters to Diverse Product Range

Live shopping initially attracted local consumers who were interested in buying products related to fashion and beauty. However, these sales channels now span various categories, including electronics, home decorations, and appliances.

According to McKinsey’s report, apparel and fashion are the most popular categories, representing 35.6% of livestreamers. Beauty products also hold a significant share, with 7.6%, reflecting the market’s strong affinity for personal care and cosmetics.

Fresh food, which encompasses a range of perishable items, is showcased by 7.4%, and electronics follows at 4.6%.

Home furnishings and decor are featured by 3.6% of livestreamers, suggesting a keen interest in home improvement and interior aesthetics.

3. The Changing Government Regulations for Live Shopping

The Chinese regulatory environment for live commerce is becoming more stringent, clearly focusing on upholding consumer rights and ensuring fair advertising practices. A step in this direction is the implementation of the “Code of Conduct for Online Streamers,” which came into effect on June 22, 2022.

These guidelines mandate live-streamers and influencers to adhere to ethical standards, promoting responsible content creation and dissemination. It highlights specific categories of content that are considered unacceptable, aiming to foster a more trustworthy and consumer-friendly livestream shopping ecosystem.

Source: South China Morning Post

These measures reflect the government’s commitment to safeguarding the well-being of viewers and the integrity of the live e-commerce sector while actively addressing the challenges that come with its growth.

4. Professionalization of Livestream Hosts

There is a marked shift in the Chinese live shopping industry where hosts are no longer seen merely as presenters but skilled professionals. They are equipped with specialized training in sales techniques, deep product knowledge, and audience engagement strategies.

This trend is driven by the desire to provide higher-quality content and a more engaging shopping experience.

For instance, New Oriental, a major educational organization, has opted to use live shopping platforms to sell products to consumers. They have utilized their academic expertise to offer content-driven livestream sessions, blending product promotion with English lessons and cultural insights.

These developments suggest that the future of live shopping in China is one where the hosts are not only influencers but also knowledgeable industry experts. More than the entertainment value most online personalities offer, these hosts provide a sophisticated and educational live shopping experience.

5. Integration of Advanced Technologies

The rise of advanced technologies such as augmented reality (AR), extended reality (XR), and mixed reality (MR) is revolutionizing China’s live shopping landscape. These immersive technologies enhance customer experiences by creating interactive environments that closely simulate physical shopping.

For example, AR allows consumers to visualize products in their own space or even try on items virtually, thereby bridging the gap between digital and physical marketing.

Image by Freepik

These innovations are particularly impactful in fashion, cosmetics, and home decor categories, where visualization is critical in any purchase decision. However, widespread adoption faces challenges like high costs and substantial hardware requirements.

Despite these hurdles, the Chinese live shopping industry is actively exploring ways to utilize these technologies more deeply into the local e-commerce experience.

6. Diverse Audience Groups

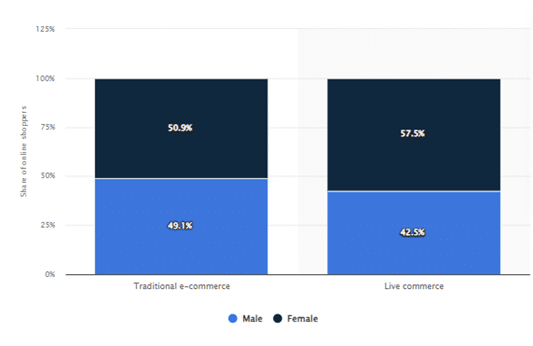

Women are a dominant force in China’s livestream e-commerce market, accounting for over 57% of this segment’s overall population. It’s mainly reflected in the product categories that hold the largest shares in live shopping, like apparel, fashion, and beauty products.

However, it is important to note that livestream shopping is not exclusively popular among women. There is also a substantial male audience that participates, particularly in categories like consumer electronics and home appliances.

Traditional e-commerce and live commerce users in China by gender (Source: Statista)

This market is also still prevalent among younger consumers, especially the Gen-Z and millennial generations. These age groups are more digitally savvy and tend to be more active in online communities, so it’s no surprise that 43% of the local live shopping user base is between 25 and 30.

7. Live Commerce’s Rural Market Penetration in China

The trend of live shopping is progressively reaching China’s rural areas. Behind this expansion is the substantial improvement in internet infrastructure across rural regions, coupled with the government’s effort to enhance digital literacy among these populations.

This digital push has enabled rural consumers, previously on the periphery of the e-commerce boom, to participate actively in the live shopping economy. Today, live commerce serves as a vital channel for rural producers and small-scale entrepreneurs to access a broader market.

Farmers and rural artisans leverage platforms like the Taobao app to directly showcase and sell their products to a nationwide audience, thus bypassing the traditional marketplace.

8. The Rise of Micro-influencers

Another shifting trend foreign marketers must discover is the rise of micro-influencers in the local live shopping market. These online personalities command smaller yet highly engaged audiences, and it’s an excellent place for your brand to start connecting with Gen Z shoppers.

Micro-influencers often harbor a sense of authenticity and relatability that resonates well with niche audiences, leading to higher trust and engagement than traditional advertising channels.

9. Sustainability and Ethical Consumerism

Sustainability and ethical consumerism are becoming more pivotal in China’s live shopping space, reflecting a global shift towards eco-consciousness. Chinese consumers are increasingly discerning regarding the sustainability credentials of every brand, affecting their purchasing decisions.

Photo by ready made from Pexels

The effects of climate change and other environmental issues have strengthened consumer concerns in China, translating into a preference for sustainable and ethically produced products, especially post-Covid-19.

Live streaming is emerging as an effective medium to showcase eco-credentials and build narratives that encourage a sustainable lifestyle. In fact, e-commerce apps like Tmall are introducing eco-friendly labeling and recycling initiatives, catering to the eco-conscious consumer and integrating sustainability into the consumer experience.

Best Live-Selling Platforms For Foreign Brands in China

- Taobao Live

Alibaba’s dedicated live-streaming platform is one of the earliest adopters in the live commerce space. The company remains one of the most popular sources of online marketplaces that are effective for engaging with Chinese consumers in real time.

- Douyin

This social commerce app has garnered an impressive 746.5 million monthly active users in the past year. Known for its young and dynamic user base of over 65% of users under 35, Douyin is especially effective for brands targeting younger demographics and seeking high engagement through short-form content and live streaming.

- Kuaishou

Another major player in the short video and live-streaming domain besides Douyin is Kuaishou. It has captured 80% of all livestream viewers in China as of September 2020. The platform’s growth has been bolstered by the pandemic, leading to a significant increase in both user base and gross transaction volume.

Quick Q&A

How big is live commerce in China?

The live commerce market in China is experiencing rapid and substantial growth, with its value surging to approximately US$352 billion in 2021. Forecasts suggest that by the end of 2023, the market could reach an estimated US$704 billion.

What is the biggest live-streaming platform in China?

The biggest live-streaming app in China is Taobao Live. The country’s tech giant Alibaba operates it and has seen a rapid increase in the number of merchants using it, particularly following the COVID-19 pandemic.

When did live shopping start in China?

Live shopping in China started gaining significant traction around five years ago but exploded in popularity during 2020, mainly fueled by the COVID-19 pandemic and the ensuing lockdowns. This period saw a substantial increase in screen time and online purchases, propelling live shopping to the forefront of local e-commerce.

Your Trusted Live Commerce Partner in China!

Foreign brands interested in China’s live-stream shopping market must carefully assess the industry’s potential and challenges. While the numbers look quite promising, it’s worth noting that Chinese consumers don’t shop like typical online users.

At Sekkei Digital Group, we understand the subtleties inherent to the Chinese market – including consumer behaviors and the ever-evolving trends that shape it. With our extensive expertise in this niche, we offer you the avenue to unlock your brand’s potential and secure a formidable position as a leading entity in the industry.

Whether it’s crafting compelling advertising campaigns, utilizing social media apps, or opening a virtual shop, we have the digital solutions you need. Contact us today, and let us help your brand navigate the intricacies of the Chinese business scene.

References:

WHY ECO-CONSCIOUS BRANDS WILL SUCCEED IN CHINA IN 2023

The live video shopping statistics brands can’t ignore in 2023

China’s Livestream Industry: Market Growth, Regulation, Enabling Technology, and Business Strategies

It’s showtime! How live commerce is transforming the shopping experience