China’s sneaker market used to be dominated by Western brands like Nike and Adidas. However, the rise of Chinese brands over the recent years has fostered tight competition within the local sports shoe industry.

Nowadays, it doesn’t matter if you’re a Chinese sneaker brand or not. International brands can find success within this lucrative market by resonating with the right audiences through appropriate digital marketing channels.

If you’re unsure of how to navigate this Chinese market segment, here are a few insights and pointers you can utilize to increase brand visibility and generate possible sales revenue.

What is the current status of China’s Sneaker Market?

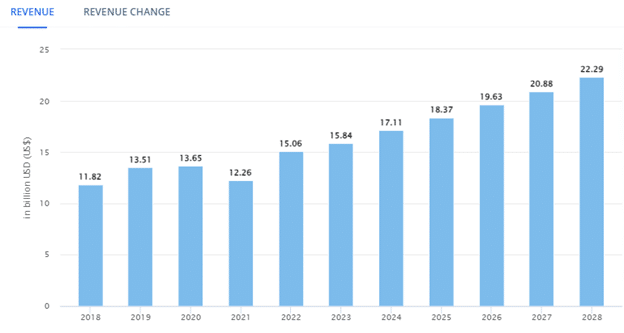

According to Statista’s August 2023 update, China’s sneaker market segment has generated a revenue of $15.84 billion. The continuous patronage of Chinese consumers for foreign and domestic brands allowed the industry to grow with an expected 7.07% Compound Annual Growth Rate (CAGR) within 2023-2028.

Revenue of Sneaker Market – China (Source: Statista)

The rapid development of the sports shoe market as a whole is primarily attributed to the growing middle class and the heightened interest of local consumers in luxury brands. This trend has allowed domestic brands like Li-ning to leverage China’s love for sports shoes.

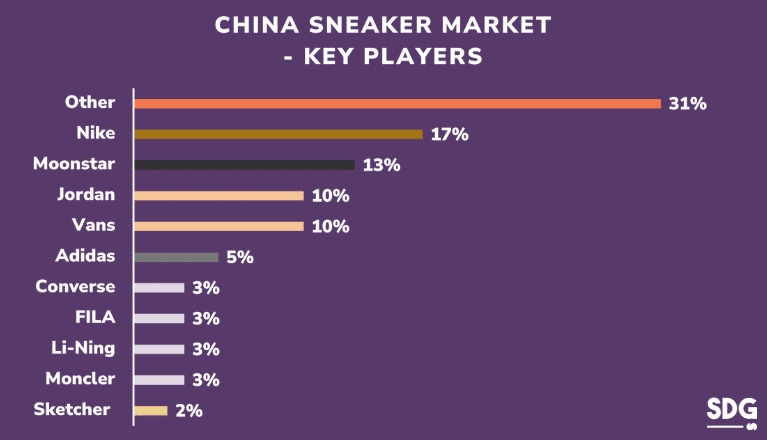

If you look at the graph below, non-local sneaker brands are still more dominant in the local market scene than those made in China. Besides Nike and Adidas, you can see a significant interest in Western companies like Vans and Converse.

Among the international brands with big names, Chinese consumers also showed interest in Japan-made footwear from Moonstar Shoes. The retail sales for this brand cover 13% of the overall market share, showing great potential despite tight competition with local companies and major sneaker manufacturers globally.

China Sneaker Market – Key Players (Source: Statista)

How Can Foreign Sneaker Brands Thrive in the Chinese Market?

1. Sell Through Chinese E-Commerce Platforms

We all know that online shopping is a prominent trend among modern Chinese consumers. In fact, recent data reported that 25.6% of sneakers bought in China are through online sales channels.

The online buying phenomenon has reached an impressive penetration rate of 81.6% in China, which is solid evidence of how e-commerce platforms thrive in the local market.

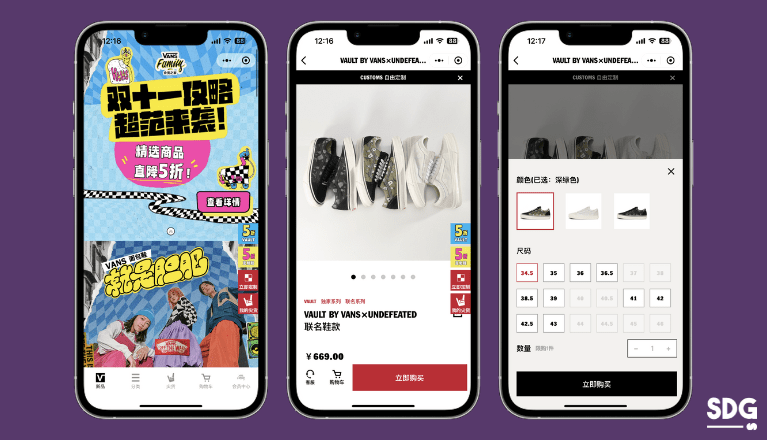

Example of Vans’ WeChat store

Non-domestic brands can generate online visibility and a positive reputation by building a presence on platforms like the WeChat Store, Pinduoduo, and The Little Red Book. You can also reach possible business partners and target audiences more effectively through dominant social commerce channels such as Tmall and JD.com.

2. Build a Strong Brand Presence within Social Media Channels

Although China is one of the largest social media markets in the world, non-Chinese brands should know that the local digital space here is not similar to the West. For starters, apps like Facebook and Twitter are restricted in the country.

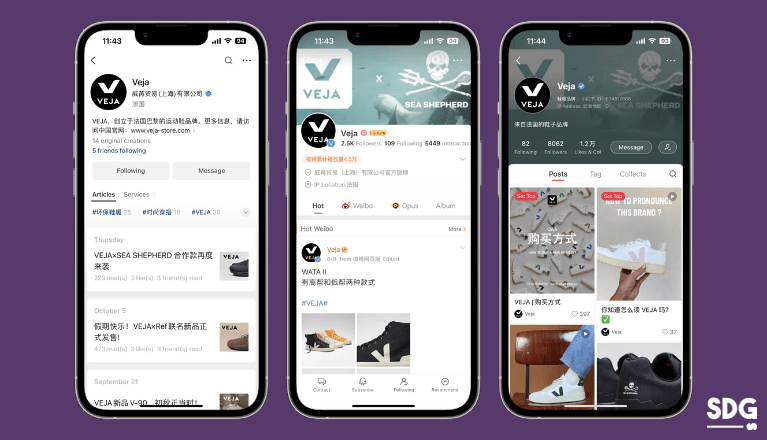

Alternatively, internet users in China use local social media platforms like Weibo, WeChat, and Douyin. These apps have a high monthly user count and include advanced targeting options to help your promotional content reach audiences specifically interested in footwear fashion and sneakers.

Example of Veja’s official accounts on WeChat, Weibo and Xiaohongshu

On top of that, some of these platforms are not only popular for their social media features but also for their e-commerce integration. Take the rise of WeChat Mini-Programs as an example.

Brands who are selling sneakers can showcase their products through this feature and utilize the platform’s built-in wallet. Because of this, users can make their purchases at ease without the need to leave the social media app.

3. Utilize Local Search Engines & UGC Platforms

Around 841.3 million Chinese internet users use search engines daily to find different online queries. Considering this massive reach, you must ensure your target users can find the content they’re looking for when they search for your brand.

Sports shoe shoppers are savvy and curious consumers. Before buying a pair, it’s not new for them to scan through local search engines to know more about the product they’re interested in, especially if it’s from a new non-Chinese brand.

Conducting a thorough market study or observing what your competitors are doing can help you develop better content marketing strategies to cater to your target audience. If you’re unsure how to do this, seeking assistance from a local digital marketing agency can save you time and money in the long run.

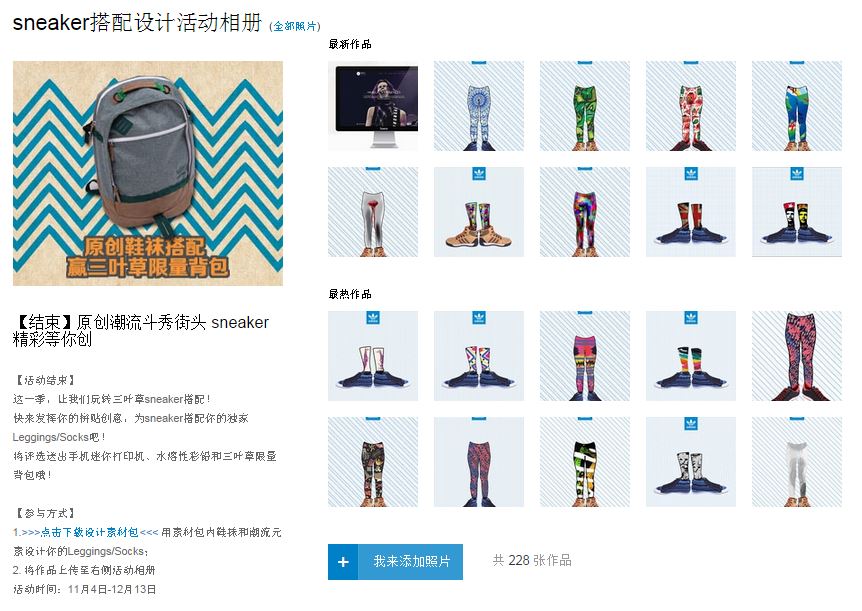

Contest by Adidas prompting users to submit their stockings and socks footwear matching design on Douban (Source: SAMPi)

Besides company websites, Chinese shoppers particularly enjoy exploring UGC platforms like Douban, Zhihu, or Baidu Baike. Building a presence on local forums gives your brand more credibility in the form of word-of-mouth marketing.

This strategy includes product discussions that can help your sneakers gain a positive reputation within the market. Through this, consumers can find reviews from other users about your brand and determine if your products align with their needs and preferences.

4. Improve Brand Reputation Through KOL Collaborations

Whether you’re trying to market casual or sports shoes, it’s worth noting that some local consumers are wary of paid advertising. When it comes to fashion or anything wearable, they tend to go for a brand recommended by their close circles or trusted influencers.

KOL collaborations allow foreign marketers to reach their target audiences more efficiently. These top influencers have sufficient followers dedicated to following their product recommendations.

Example of a KOLs mini-party for our client Veja

Remember that not all Key Opinion Leaders (KOLs) can reach the same demographics, so we recommend checking their content and audiences to know if it aligns with your marketing goals.

You should also select a KOL carefully because they’ll represent the brand during the campaign period. Don’t forget that this collaboration also means you’re putting your brand reputation on the line.

Do International Brands Need to Open Physical Stores?

Having a physical presence in China can help the brand generate more exposure. However, the process of implementing this operation is not only time-consuming but also costly.

While it’s expected for big brands like Nike to sell their sneakers and apparel items through physical stores or malls, China’s digital space now allows new brands like yours to distribute and sell your products in different online channels or partnerships.

Photo by Declan Sun on Unsplash: Nike store exterior in Shanghai, China

Tips to Overcome Fierce Competition Within China’s Footwear Industry

● Offer High-Quality Products

The success in selling sneakers in China depends on innovation and high-quality production. Chinese consumers are savvy online shoppers, so no matter how great your sneaker marketing strategy is, it cannot mask the low product quality.

As previously stated, local online shoppers are keen on word-of-mouth marketing rather than advertisement. It’s also why most of their e-commerce platforms include social media features to help users exchange product experiences and discover new brands that suit their preferences.

● Consider the Current Fashion Trend

When it comes to sports shoes, Chinese consumers are leaning more positively toward brands that resonate with a comfortable lifestyle and premium designs. The growth of disposable income among middle-class consumers also drives their appetite for luxury items.

Marketers can also ride the wave of popular sports events like the Olympic Games or the World Cup, as these are the seasons where locals highly seek sneakers.

You may not know, but national pride drives Chinese consumers to buy these shoes to show support for the local teams.

● Conduct Market Study Of Local Sneaker Brands

The rise of local sneaker manufacturers like Li-Ning and ANTA is also instrumental to the Chinese craze for branded sports shoes. Their local appeal also meant they could resonate with Chinese consumers better on a cultural level.

By observing how they market and sell to their audience, foreign marketers can determine which strategies to use and not to use.

● Appeal to the Younger Generation

Casual and comfortable shoe trends mainly stem from the lifestyle of younger Chinese consumers. Besides that, the typical consumer demographics of footwear in China are students taking GaoKao who are around 17 to 20 years old.

Photo by Yasmin Dangor on Unsplash: Person wearing Chinese sneaker brand Feiyue

FAQ

How big is the shoe market in China?

China’s shoe market covers 60% of footwear manufacturing around the globe. In 2023, its projected revenue reached around $82.82 billion, with an annual growth rate of 3.77%. Meanwhile, its sports shoe segment accounts for $12.24 billion of this revenue, thanks to the growing patronage of the middle class for sports events and fitness lifestyles.

Which country is the largest consumer of sneakers?

China is the largest consumer of sneakers worldwide, with more than 3.93 billion pairs of shoes sold based on 2022 data. This statistical data is not a surprise, mainly because these numbers mirrored the country’s massive population.

What is the largest sneaker company in China?

The prominent Chinese sneaker brand is Anta Sports Products Limited. However, if we account for the Western brands in the local market, it’s only the third-largest after Nike and Adidas.

Ready To Dominate The Sneaker Market in China? Get In Touch With Us Today!

The sneaker market in China is not a new territory for foreign brands. With big international companies dominating the local business scene, it gives marketers the impression that it’s easy to thrive within the industry. However, that’s not always the case for new brands.

At Sekkei Digital Group, we understand the specific complexities of the sneaker market segment in China–including consumer behaviors and the ever-evolving trends that shape it. With our extensive expertise in this niche, we offer you the avenue to unlock your brand’s potential and secure a formidable position as a leading entity in the industry.

Whether it’s crafting compelling advertising campaigns, utilizing social platforms, or collaborating with relevant KOLs, we have all the digital solutions you need. Contact us today, and let us help you navigate the intricacies of China’s sneaker business scene.

References:

Sneakers – China

China’s sneaker market thrives as the middle class grows and consumer preferences evolve

INSIDE THE CHINESE SNEAKER MARKET TAKING THE GAME BY STORM!

Meet The Consumer Class Fueling China’s Sneaker Market