As the bearer of most household purchasing decisions, the power of female consumption in the Chinese market cannot be overlooked. In fact, women in China are considered the third-largest consumer group in the world. It has an impressive market size equivalent to the value of the combined retail markets of Germany, France, and the UK.

As more women utilize their spending power on products catering to their specific needs, it opens an opportunity for foreign brands to appeal to this local demographic.

Read along as we explore the “She Economy” in China and discuss the different trends and strategies you should know to gain the brand loyalty of Chinese women consumers.

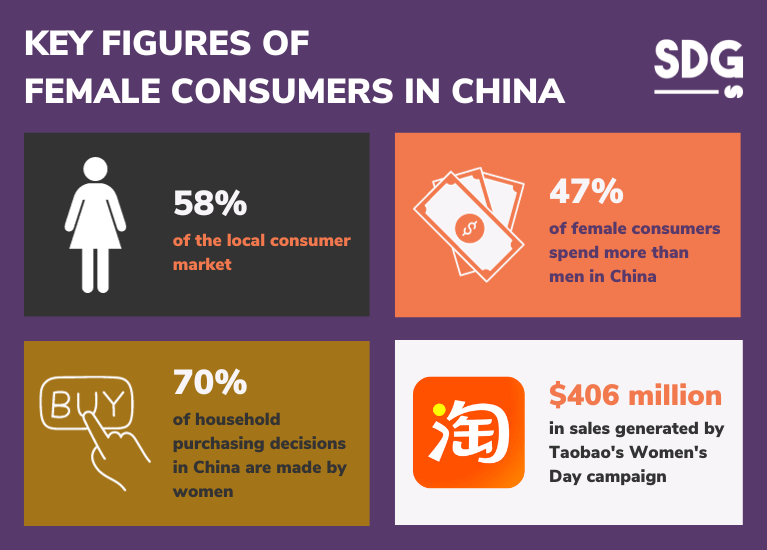

Key Figures of Female Consumers in China

With Chinese women covering over 10 trillion RMB of the country’s overall annual consumer spending, catering to this demographic becomes increasingly critical for new businesses entering the local market.

Here are the key figures you should know to build loyalty and generate sales effectively from Chinese female consumers.

- Chinese women account for 58% of the local consumer market

- 47% of female consumers spend more than men in China

- Taobao’s Women’s Day campaign generated $406 million in sales

- Around 70% of household purchasing decisions in China are made by women

Top Trends You Should Know About China’s She Economy

● Increasingly Growing Buying Power of the She Economy

The financial independence of millennial and Gen Z Chinese women primarily prompts the rapid growth in China’s female consumer market. Like it or not, today’s younger generation is no longer strictly bound by traditional gender roles set by society.

A recent report states that 61.07% of Chinese women actively participate in China’s labor workforce. While the penetration is not as high as its male counterpart, the consistent growth of this demographic shows that female consumers are more than capable of spending money for their self-fulfillment.

Image by Freepik

On top of that, the spending trend of local women seems to also focus on mobile shopping services. According to Statista, around 446 million female consumers buy goods through this medium.

The evolving trends in China’s female consumer group have led more brands to provide products and services supporting women’s needs and wants.

● Chinese Women & Their Significant Role in Home Purchases

While the rise of modern gender roles did affect how younger women spend their money, the older female population are still the dominant figure in deciding family purchases. In an HSBC 2020 report, 3 out of 4 purchasing decisions at a Chinese family home are made by women.

An example of this trend is the growing demand for home appliances in China. Most women in local households are keen on acquiring energy-saving goods when buying house gadgets like washing machines, refrigerators, or dishwashers.

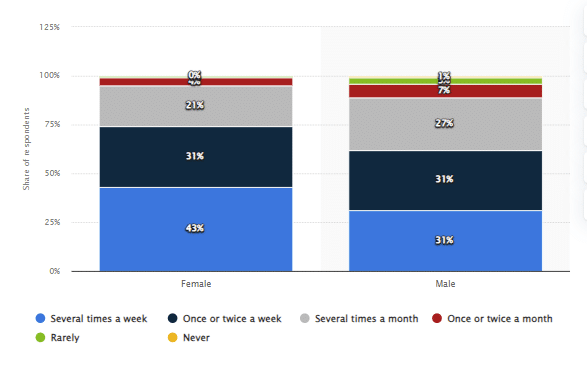

Frequency of online purchases in China 2022, by gender (Source: Statista)

If we look at the report above, more women are likely to shop in e-commerce channels several times a week. This buying habit is not exclusive to the family but also for the household pet needs.

An Alibaba growth report showed that pet food sales have increased by 15% compared to the past year. And since 60% of pet owners in China are women, it’s safe to say that this specific demographic has contributed to this development.

● Increased Demand from Single Female Consumers

Household purchases for the family are not the only products Chinese women have been interested in recent years. In fact, the rise of single female consumers has led this demographic to spend more money on products that cater to their own happiness.

In 2022, China has seen reports on the population decline in over sixty years. It presumably stems from the decrease in marriage and birth rates.

Despite government efforts to reverse this trend, including incentives like extended paid leave for newlyweds and subsidies for childbirth, many women remain on their stance of being single.

These changes are fostering a new dynamic in consumer behavior, particularly among single female consumers, who are increasingly becoming a significant economic force in the market.

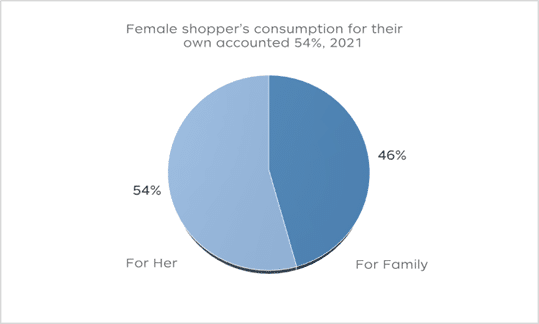

Source: JD,com Corporate Blog

Recent reports by JD.com say that 54% of women in China gravitate to spending for their own needs rather than their families. This data is backed by the increased consumption of luxury items, education, tourism, and health services by the local female population.

● Chinese Women’s Interests in Health and Wellness

In China, there’s an ongoing trend surrounding health and beauty supplements among the local female population. These innovative products range from nutrient-enriched smoothies to vitamin-infused gummies, all aimed at addressing women’s unique health and wellness requirements.

Beauty supplements that enhance skin and hair quality and overall physical appearance are also gaining traction in the country. This sector is experiencing robust growth, with a compound annual growth rate of 10.4%, signaling substantial opportunities for market expansion.

SDG’s work with ELEVANT®

The renewed interest of women in health and wellness also opened the doors for the comeback of traditional Chinese medicine and plant-based, natural remedies in the business scene. These product categories are increasingly favored by the younger generations, who are now more inclined to incorporate natural supplements into their health regimen.

It’s a shift that emerged during the onset of the pandemic. About half of China’s Gen Z and younger female population have recently heightened their use of vitamins and supplements.

● The Rise of Medical Beauty Aesthetics

Fueled by the traditional beauty standards in China, there’s been a notable surge in the popularity of cosmetic surgery among younger women. Looking at the recent growth report by Deloitte, the medical aesthetics market has reached a value of 200 billion yuan.

Image by prostooleh on Freepik

Remarkably, the changing times allowed cosmetic surgery to gain widespread acceptance in China. Approximately 80% of Gen Z women in China are considering such procedures, and over 60% are prepared to invest more than 5,000 yuan in a single medical procedure.

● The Focus on Premium Self-Care & Beauty Products

Chinese women are also proud consumers of high-end cosmetics and self-care products. Younger customers, in particular, are highly interested in having exclusive access to upscale brands.

Anyone can see the prevalence of these trends when you scan through the user-generated content on Little Red Book (Xiaohongshu). Believe it or not, over 20,000 posts on this social media platform primarily discuss luxury goods in the beauty and wellness sector.

How To Promote Your Brand In The Female Consumer Market

1. Build Brand Awareness Through Social Media

The She Economy in China is further fueled by the influence of social media on online consumption within the local business scene. These channels are dominated by platforms like Weibo, Douyin (TikTok’s Chinese counterpart), and Xiaohongshu (Little Red Book), where female consumers engage with lifestyle, beauty, and fashion content.

Your choice of platform highly matters in how your brand will be presented on social media. As you know, not all these apps offer the same content creation or promotional tools.

Lancôme on Douyin

Some beauty brands like L’Oreal and Lancôme get a lot of engagement from local consumers because they learned to leverage Douyin’s advertising formats and other features.

While interactive and visually appealing content, such as short videos and live streaming, are popular in social media, you must tailor your content to resonate with the interests and values of your target market. Ensure that your campaigns include culturally relevant themes, trends, and language.

2. Participate in Shopping Events on E-Commerce Platforms

International Women’s Day is a widely celebrated online event on different e-commerce platforms in China. It also coincides with the country’s Mother’s Day, so it’s only natural that many Chinese consumers look forward to special discounts implemented for this shopping festival.

Like the rest of the world, Chinese customers commemorate this event on March 8th. Tmall and JD.com often call it “Queen’s Day” or “Goddess Day.”

It’s also an opportunity for foreign brands to ride the surge and demand arising from the Women’s Day celebration.

Besides Women’s Day, you can also consider participating in events like Singles’ Day (Double 11). Not only is it the largest e-commerce festival in China, but it also aligns with the increasing number of single female consumers.

Don’t forget to choose the right e-commerce platform based on your product category and target audience.

3. Tailor Your Marketing Strategies for Female Consumers

To forge a deeper emotional bond with female customers in China, brands should craft marketing narratives and product selections that reflect the values and interests of this demographic.

Developing a brand story that aligns with the aspirations and emotions of female customers is crucial. It involves crafting a compelling narrative that not only connects on an emotional level but also fosters brand loyalty.

A skincare company, for example, might center its branding around themes of self-care and self-love, striking a chord with women who value personal well-being.

4. Collaborate With Popular Beauty KOLs

When it comes to female consumption, it’s important to note that women in China crave to be represented. Because of this, they’ll likely follow Key Opinion Leaders (KOLs) that align with their interests and online shopping needs.

Consider partnering with KOLs who align with your brand image and have a solid following among Chinese women. Researching and choosing KOLs with genuine influence and engagement with their audience is essential for a successful campaign.

KOLs for Perfect Diary on Xiaohongshu

When you collaborate with them for product reviews, tutorials, and branded content, these online figures can provide credibility and relatability that eventually sways their fanbase’s purchasing decisions.

However, remember that overly promotional or scripted content can be off-putting to consumers, so ensure the collaboration feels authentic and genuine.

5. Develop Personalized Branding For New Customers

Personalization is a key strategy in appealing to this segment. By offering individualized product recommendations, dedicated customer service, and exclusive event access, brands can create unique experiences that resonate with Chinese women.

Brands must also focus on empowering women and celebrating their achievements. Foreign marketers can achieve this by designing marketing campaigns that advocate for gender equality and by collaborating with organizations dedicated to women’s causes.

Such initiatives should highlight and celebrate women, demonstrating a brand’s commitment to supporting and empowering female consumers.

Quick Q&A

How big is the female consumer market in China?

This segment generated a staggering value exceeding 10 trillion yuan (around US$1.53 trillion) in 2020. It’s mainly dominated by over 400 million female consumers aged 20 to 60, covering 70% of household purchases across various sectors.

What are female Chinese consumers buying?

Female Chinese consumers predominantly purchase products in categories such as beauty and personal care, fashion and apparel, and health and wellness products. They also show strong interest in high-quality, international brands and are increasingly engaged in online shopping, particularly for luxury goods and services.

Ready To Dominate The She Economy in China? Get In Touch With Us Today!

There’s no single, effective way of marketing your products and services in China’s She Economy. It includes different consumer habits, preferences, and trends, so it’s only natural for foreign brands to find this segment incredibly challenging to navigate.

At Sekkei Digital Group, we understand the complexities of Chinese female consumers–including their purchasing behaviors and the ever-evolving trends that shape them. With our extensive expertise in this niche, we offer you the avenue to unlock your brand’s potential and secure a formidable position as a leading entity in the industry.

Whether it’s crafting compelling advertising campaigns, utilizing social platforms, or collaborating with relevant KOLs, we have all the digital solutions you need. Contact us today, and let us help you navigate these intricacies.

References:

China’s ‘She Economy’ Booms As Women Invest In Their Own Happiness

4 Trends in China’s ‘She’ Economy and How Brands Can Tap Into It in 2023

Winning Over The ‘She Economy’: How To Tap Female Consumption In China

Are China’s female consumers holding more than half of the sky?

Women’s Rising Consumer Clout Propels