As the pandemic restrictions dwindle, experts quickly noted how inbound and outbound tourism in China is slowly regaining its previous glory. With this positive market insight, Chinese consumers remain among the most sought-after groups in the travel retail industry.

The evident rise of domestic tourism in the past few years made major travel retail destinations abroad more eager to attract Chinese travel shoppers their way.

However, the changing preferences of Chinese travelers aren’t as simple as you think. If foreign businesses want to divert the growing demand for domestic tourism in China, they must know the evolving needs of this consumer group.

In this article, we’ll share insights on China travel retail market and discuss how foreign businesses leverage the growing number of Chinese traveling consumers.

What does “Travel Retail” mean in China?

“Travel Retail” refers to the sales of goods and services to Chinese consumers within transportation hubs such as airports, railway stations, and border crossings worldwide. This concept has gained significant importance in recent years due to the exponential growth of travel and tourism in China.

Over the years, mandatory prior reporting and prolonged layover periods in airports have a joint venture into fueling the duty-free travel retail market.

And with more disposable income each year, new Chinese tourists are expected to generate more revenue for the travel retail industry. The rapid rise of this consumer sector is also mainly due to its focus on luxury goods, duty-free items, and technology-driven shopping experiences.

How big is the Chinese travel retail market?

The noticeable scale of massive international travel consumption from Chinese consumers started around 2019 when the country recorded high air traffic of 155 million outbound trips. If you look at the previous data, it’s three times larger than the data from 2010.

And while the Chinese travel retail market isn’t immune to the effects of the international travel decline in 2020, the segment managed to bounce back and maintain a decent market size of $20 billion in 2023.

The rise of domestic travelers in 2021 led the profitable industry to shift focus to local duty-free shops, achieving annual growth of 66.8%.

As more customers return to travelling in and out of the country, the travel retail market growth within the forecast period of 2023-2028 is expected to reach around $64.23 Billion. This major share insight proves that China is still one of the industry leaders in the travel retail sector.

7 Shopping Tourism Trends in China’s Travel Retail Market

The travel retail market in China includes ever-evolving consumer dynamics. From the profound influence of Generation Z to the top social media channels transforming the landscape, here are some trends foreign businesses must take note of to attract Chinese travel shoppers.

1. China’s Gen-Z are leading the travel shopping market

As discussed in the recently concluded TR Consumer Forum, 66% of Chinese travelers going abroad were aged 34 or below. So if you haven’t been paying attention to China’s Generation Z, now is the time to start.

Like their global peers, China’s 90’s kids emphasize self-expression and expect brands to be socially and environmentally responsible.

However, China’s Gen Z also strongly values their national identity and prefers Chinese brands, including C-beauty products. It’s a significant shift from older generations who considered foreign premium brands a symbol of quality and social status.

Foreign brands aiming to attract Chinese shoppers in the travel retail market must put in extra effort by showing a deep understanding of the local business scene.

Brands must stand out as responsible entities with well-defined values in China and worldwide. It can involve transparent supply chains, fair trade labels, charitable donations, and community involvement.

2. Chinese duty-free shoppers often plan their purchases

Did you know that most Chinese travelers who buy duty-free items in physical stores go out of their way to plan what they’ll purchase?

Unlike before, Chinese tourists don’t solely rely on online travel agencies to plan their trips. The recommendations and trends via social media platforms are the catalysts of this change. Because of this influence, they also have more control over which foreign or duty-free goods they want to purchase during their travels.

The tradition of Chinese travelers planning their shopping well ahead of time has become even more prevalent than before the pandemic.

Most consumers begin planning their shopping lists even before setting off for the airport, regardless if they’re planning to splurge or just pick up a few products. More often than not, travelers already know what they’re going to get due to the extensive reach of top Chinese social media platforms.

This purchasing behavior gives foreign duty-free retailers a fantastic opportunity to connect with consumers in advance.

And if you’re unsure of how to do this, we suggest seeking the help of a reliable digital marketing agency to handle your targeted advertisements, marketing campaigns, or WeChat mini-programs.

3. Peak Chinese travel retail consumption during holidays

Notably, Labor Day Weekend and National Day Golden Week are prime periods of heightened leisure travel activity in China. It’s also the season when the retail travel market is booming.

While most festivities within the country attract more domestic travelers, the May Day holiday is anticipated to boost sales due to the surge in outbound travel from China to international destinations. Because of this, brands must prepare to engage with a travel-ready audience.

Hainan Duty-Free Shopping Mall. Source: DaoInsights

4. The Hainan shopping experience effect

One of the retail market facts you must know is that Hainan free trade port has a high potential to be the biggest duty-free market globally.

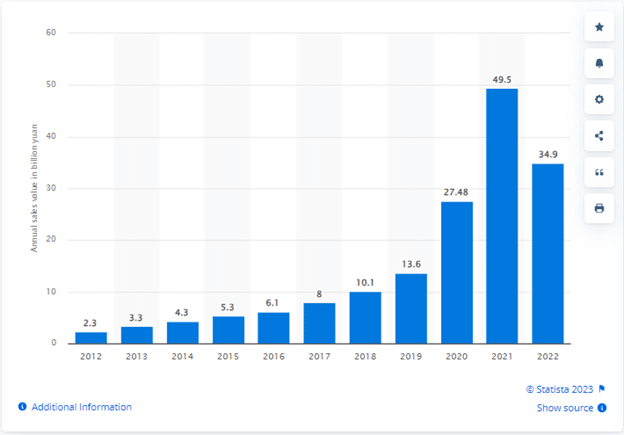

From 2020 to 2021, duty-free sales in Hainan increased by 83%. In 2021, the number of shoppers grew by 73%, reaching over 10 million people. Duty-free purchases also increased by 71%, totaling around 49.5 million transactions compared to the previous year.

Hainan province has become a hotspot for travelers looking to purchase luxury goods, like premier branded clothes, fashion accessories, etc. Its expanding market size makes more luxury brands attempt to enter this local sector.

Source: Offshore duty-free sales value in Hainan, China 2012-2022

Foreign duty-free operators should also know that some Chinese travel shoppers are now noting price differences through Hainan’s WeChat mini-program.

And because the duty-free market in Hainan province is the standard for first-time Chinese outbound travelers, overseas shopping malls and brands are highly advised to recreate a similar shopping experience to attract this consumer group.

5. The demand for luxury goods during outbound travels

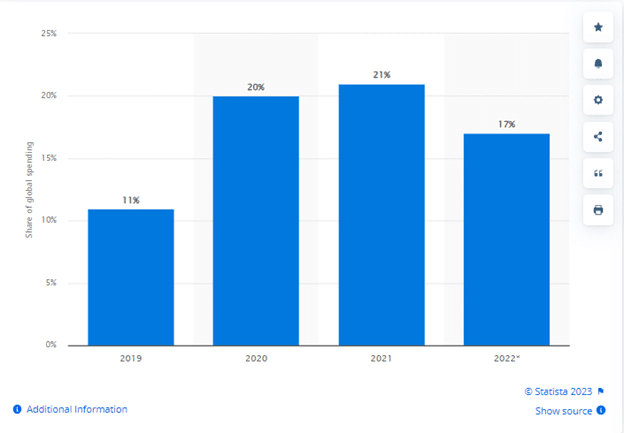

The revival of Chinese outbound tourism also heightened the local consumers’ appetite for luxury goods in the travel retail market. If you look at the graph below, you’ll see that China still covers a whopping 17% of the global luxury market expenditure.

Although the market saw a bit of a decline in 2022, it doesn’t change the fact that international travelers from China are avid consumers of luxury items.

Source: Chinese consumer expenditure share in the global luxury market 2019-2022

6. The Chinese Market is extremely digitalized

The outbound travel restrictions during the pandemic have made the Chinese market rely on digital channels, like cross-border e-commerce platforms, to gain access to foreign goods available in duty-free shops.

While offline duty-free business owners took a blow during the pandemic, digital technology managed to bridge the gap between consumers and brands.

The blend of online and in-person platforms has played a role in boosting the travel retail sector. Foreign businesses use innovative technologies like augmented reality marketing and live streaming to attract customers and raise brand recognition, contributing to industry growth.

For example, the shift towards online shopping and e-commerce platforms has given China Duty-Free Group to bounce back in the travel retail market. The group’s expansion in WeChat mini-programs and other social commerce apps helped them generate over 24 million members in the third quarter of 2022.

And now that the country has relaxed entry and exit policies, the China Duty-Free Group also has seen a significant 29.68% rise in their 2023 sales.

7. The convenience of mobile payments

For Chinese individuals new to traveling, creating a welcoming atmosphere with recognizable payment methods and signage in their language becomes crucial for their comfort when visiting international duty-free shops.

Overcoming the payment hurdle is significant, as Chinese consumers prefer using mobile payment methods, particularly WeChat Pay and AliPay, which should be embraced by foreign brands looking into tapping this market.

Besides duty-free charges, Chinese tourists seek out these payment methods for loyalty programs and discounts.

How do traveling Chinese consumers differ from other shoppers?

Chinese consumers exhibit a solid inclination to share their shopping experiences online, a trend particularly prominent among Generation Z. This consumer group highly regard the opinions of their peers, with 62.8% of Chinese Gen Z expressing their willingness to share favored products on the Internet.

Additionally, 53% acknowledge discovering brand-new brands through social channels. Because of this, offline stores abroad are now eager to invest in building an extensive social media presence in China by utilizing platforms like WeChat Moments, Xiaohongshu, Douyin, etc.

Furthermore, a distinctive e-commerce phenomenon among local consumers is the concept of ‘community group buying’ or CGB. It’s a prevalent trend in the travel retail industry as it facilitates collective purchasing via platforms (WeChat mini-programs or Pinduoduo) to pool orders and access bulk discounts.

Ready To Dominate The Chinese Travel Retail Industry? Get In Touch With Us Today!

The changing consumer behavior and traveling appetite in China is a challenge many foreign brands must learn to overcome to thrive in the travel retail industry.

At Sekkei Digital Group, we deeply grasp the intricacies of the Chinese retail travel market – encompassing consumer behaviors and the ever-shifting dynamics that define it. Leveraging our extensive knowledge in this specialized field, we can assist you in tapping into your brand’s potential and establishing a commanding presence as a frontrunner in the industry.

Whether it’s crafting compelling advertising campaigns, utilizing social media platforms, or making waves with PR, we have the digital solutions you need. Contact us today, and let us help you navigate the intricacies of the Chinese retail travel scene.

References:

How Chinese Shoppers Approach Travel Retail in 2023